The Dubai-based owner of Leeds United said on Wednesday denied it was planning to sell its entire stake in the club but was seeking new investment.

“To clarify and as previously stated, GFH Capital is looking for investment in part of its share in the club, not its entirety,” the owner said in a statement issued by the English championship club which it took over three months ago.

“GFH Capital has been transparent since acquiring Leeds United and is continuing to look for strategic investors in part of the club that can invest in Leeds United, alongside GFH Capital, to ensure a long term, sustainable future,” it added.

The statement contrasts with comments from Gulf Finance House, the parent company of GFH Capital, which said in its annual financial report that it was looking to sell its stake and that negotiations on a deal had begun.

GFH Capital purchased the club from majority shareholder Ken Bates at the end of last year after negotiations that lasted for several months.

Since GFH Capital took ownership of Leeds United, it said it has invested around £10m to strengthen the squad and for other working capital purposes.

“To date, GFH Capital has fulfilled the plans pledged and its strategy for the club remains the same; to build a group of strategic investors to put Leeds United in the best position both on and off pitch for the long term,” it added.

In December, Leeds United Football Club posted an operating loss of more than £3m.

The figures showed that turnover was also down 4.9 percent in the year to June 2012.

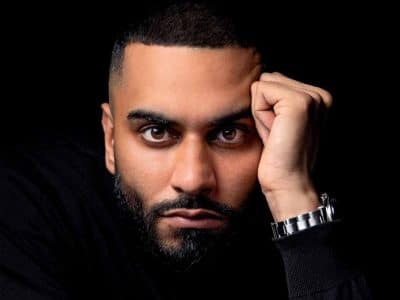

GFH Capital board member Salem Patel told a news conference at the time that it would not spend “crazy money” to restore the Championship (second division) club to the elite Premier League.

Accounts published last month by GFH Capital’s parent, Bahrain firm Gulf Finance House said: “The Group has an active plan to sell its stake in LUFC Holdings Limited, and accordingly, the asset and liabilities acquired were classified as held-for-sale and presented in the consolidated statement of financial position.”