Dubai-based Buy Now Pay Later (BNPL) player Postpay has secured $10 million in equity investment, which is set to accelerate growth and fuel expansion plans for the MENA region.

The investment was secured from AP Ventures and global BNPL leader Afterpay.

Tariq Sheikh, founder and CEO of Postpay, said: “We are extremely grateful and excited to have Afterpay and AP Ventures as part of our investor-base. Afterpay are the pioneers of the zero cost to-customer model, and we are honoured and privileged to work with them.

“For Postpay, this strategic investment provides not only capital to enable us to accelerate our growth but also an opportunity to collaborate and bring new learnings from our new shareholders as we expand in the MENA region.”

The BNPL market is projected to increase by 400 percent to $352 billion by 2025 from $89bn in 2020.

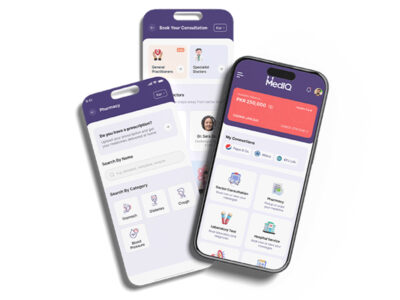

Founded in 2019, Postpay works with hundreds of leading global brands, including H&M, Footlocker, Dermalogica and regional merchants such as The Entertainer, Kcal and Squat Wolf.

Tariq Sheikh, founder and CEO of Postpay

Tariq Sheikh, founder and CEO of Postpay

The company offers shoppers the option to pay in three monthly instalments at their partner stores with absolutely no interest or fees. While they shift costs to retailers as a premium payment gateway (often charging over five percent per transaction) – their solution increases conversion rates up to 30 percent, average order values by over 50 percent and reduces return rates by over 25 percent – all with no added risk for retailers as they get settled up front on a weekly basis.

Anthony Eisen co-CEO and co-founder at Afterpay, said: “We are excited to support Postpay as they grow the buy now, pay later market in the Middle East. We have seen first-hand the incredible uptake of BNPL globally and have no doubt that Postpay will deliver a best-in-class solution across the Middle East.”

The popularity of BNPL products, which are used as an alternative to credit cards, has surged throughout the Covid-19 pandemic, alongside the boom in ecommerce, which was fuelled by the various lockdown restrictions.

In addition to the investment from Afterpay and AP Ventures – which is expected to complete in the coming days – APV will be nominating a director to join the board of directors of Postpay.

Hein Vogel, CEO at AP Ventures, said: “We believe that Postpay has an extremely strong team, product and partner-base to ensure market leadership in the region. We are proud to be a part of this journey in the Middle East – a region with such impressive growth.”