The boss of a Turkish real estate company working on projects such as Trump Towers Istanbul has warned Gulf investors about impulse buying in his country amid growing investor interest in Istanbul.

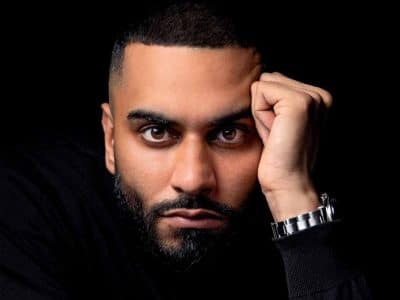

Speaking at Cityscape Global, Tolga Han, international vice-president of Projebeyaz International, said while Turkey presented plenty of good investment opportunities people could also be ripped off.

With 35 Turkish exhibitors at Cityscape Global, it was the biggest country showing at the event outside the Gulf region.

Han said there was currently about $3bn of investment in Turkey coming from the Gulf, with recent changes in Turkish regulations making it easier for foreigners to buy property. However, he wanted this increased to up to $10bn within the next five years.

About 15 percent of total sales at Projebeyaz came from the Middle East, with the company hoping to increase this to 50 percent over the next three years.

“Whatever they want to buy, they must consult,” Han told Arabian Business at Cityscape.

Projebeyaz International have promoted several Istanbul projects at Cityscape, including the $450m Trump Tower, $250m Cengelkoy Villas, $1.5bn Macka Residence, $90m Gunesli Residence, $20m Marmaroom residences and $190m Kempinski Residences Astoria.

The property options were a mixture of sales and lease.

Han said the Istanbul property market was tight, though price growth averaged 12 to 15 percent annually.

He said while it was popular city, it was also cheap. The average price was $2,500/ square metre.

“Of course there are many high-quality projects right now with $10,000/sqm, $15,000/sqm,” he said.

Han said the returns on off-plan projects could double in two years in the right deal. However, the minimum gain was 15-20 percent over the same timeframe for established projects, he claimed.

Rental returns averaged about seven to eight percent annually.

“But, all the GCC investors are looking for 10, 12, 15 percent. It’s not possible in Turkey right now,” he said.

Han said feedback at Cityscape showed people were looking for their second home, but were being cautious until they better understood the Turkish market.

He said London remained the preferred investment choice, along with European cities such as Zurich in Switzerland and the US.