The Government of Dubai’s Land Department said on Tuesday that the emirate saw a total of AED53bn($14.4bn) worth of real estate investments in the first half of 2013.

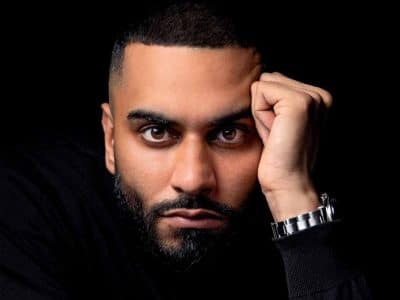

Sultan Butti Bin Mejren, director general of the Land Department hailed Dubai’s real estate market as a “lucrative one for its stability, diversity and promise of high return on investment”.

“These factors continue to inspire confidence in local, regional and international investors alike, whose transactions in turn contribute to sustained momentum of the market’s growth – signifying complete recovery from the global financial crisis,” he said.

Arab investors contributed to approximately AED5bn on investments in Dubai property in H1 – a 111 percent increase in spending while Gulf nationals spent over AED16bn, a 57 percent rise.

The figures showed that foreign investors remained the biggest spenders with over AED32bn – a 73 percent increase on the same period last year.

The report also showed that Indian investors topped the list for foreign investment in Dubai’s real estate sector with 499 involved in transactions worth over AED8bn.

Pakistani investors were second with 3,285 investors spending over AED3bn, followed by British investors with 2,389 inking deals worth AED4bn.

Findings also indicated a growing number of Arab investors, with Jordanians leading the way with 598 spending AED1bn.

Bin Mejren said: “An increase in the volume of investors from diverse backgrounds reflects the success of various policies and initiatives introduced by the government of Dubai throughout the year, which have had an invaluable impact on attracting investment from all over the globe who look for a safe and rewarding place to spend.”

He added that current statistics reveal “beyond a doubt the coming period will be a promising one, where the Land Department expects to see an unprecedented amount of spending”.

The figures come just hours after Dubai’s government announced plans to establish a legal committee to liquidate cancelled property projects and settle related disputes, including paying out investors who have struggled to get their money back from developers.

Countless projects were announced during the Dubai property boom but were postponed or cancelled – either partway through construction or before work had begun – when the market dramatically dropped in 2008-09.