The head of Qatar’s $450bn sovereign wealth fund said it will use the current global economic turmoil as an opportunity to rebalance its portfolio and is considering investments in football, finance and tech.

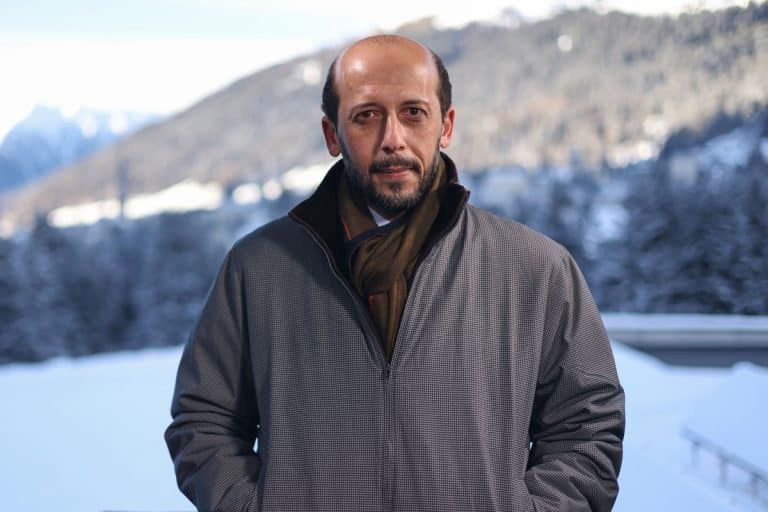

The Qatar Investment Authority is looking for opportunities in Europe, Asia and the US in sectors such as venture capital, fintech and sustainability, CEO Mansoor Al Mahmoud said in a Bloomberg Television interview at Davos on Monday.

The World Economic Forum returns to the resort during the winter for the first time in three years this week.

Qatar eyes football and finance deals

“It’s a challenging time. Inflation is the main topic for the global economy,” he said.

“We see this as an opportunity to reposition our portfolio. We highlight the weaknesses we have in our portfolio and we wait for these sort of corrections in the market to fulfil the weaknesses we have.”

Sovereign wealth funds from the oil-rich Gulf region continued to be active acquirers last year, even as global deal volumes fall and banks cut bank lending for acquisitions.

The QIA in October agreed to invest €2.4bn ($2.5bn) in RWE AG to back the German utility’s purchase of US renewable assets. It was also a cornerstone investor in sports car brand Porsche AG’s IPO and has invested in a string of tech startups.

Known for its penchant for trophy assets, the QIA backed lenders such as Barclays and Credit Suisse during the 2008 financial crisis.

While a more recent focus on closely-held tech companies has taken it to growth markets, soaring energy prices are adding extra fuel to its return to big-ticket deals.

Financial institutions remain a “very important pillar” in its portfolio and investing in them “will always be a theme for us. We’re also moving into fintech,” he said.

After Qatar successfully hosted the most expensive World Cup ever, the fund is also considering investing in football clubs, but hasn’t decided whether to pull the trigger on any specific investment, Al Mahmoud said.

“This is a very commercially driven decision,” he said. “Sport is becoming a very important theme as well; people are engaged more in sports and digitalisation is making it more attractive to investors.”