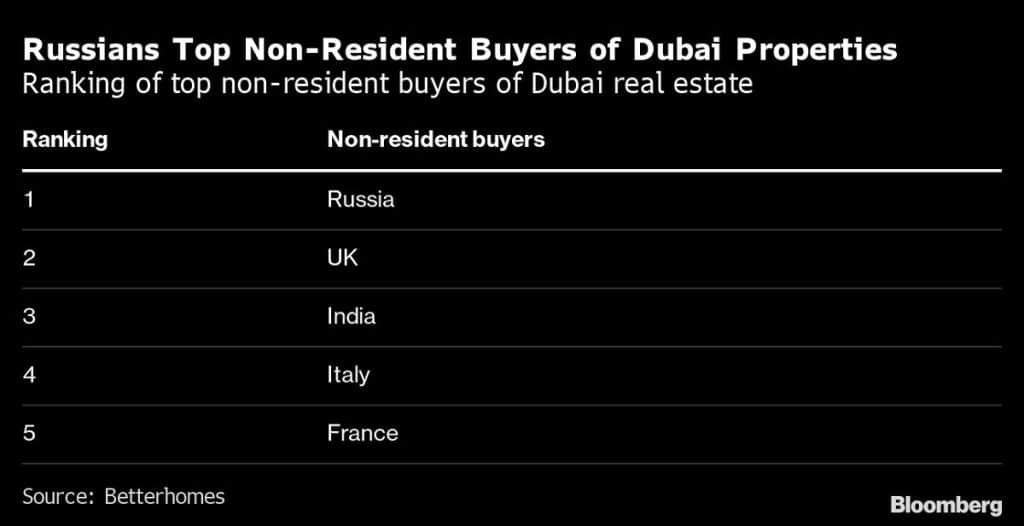

Russians were the biggest international buyers of Dubai real estate last year, when the city emerged as a safe haven amid geopolitical and economic uncertainty elsewhere, according to brokerage Betterhomes.

Once a niche group of buyers in Dubai, Russians’ interest surged after the war in Ukraine as their nation faced ever tighter sanctions, helping to push the value and number of sales to record levels.

Dubai registered more than 86,000 residential sales transactions last year, surpassing a previous record of 80,000 in 2009, according to Dubai-based Betterhomes.

Dubai property market growth

About AED208bn ($56.6bn) worth of property was sold last year, an almost 80% gain from 2021.

The increase in prices slowed to 11% in 2022 from 21% a year earlier, it said.

The property market in Dubai has bucked the trend in much of the world, where home values have dropped amid surging interest rates and a darkening growth outlook.

Prices and rents in the emirate have also been buoyed by bankers fleeing strict lockdowns in Asia, Israeli investors, crypto millionaires, and hedge fund executives.

European buyers also dominated property transactions in the emirate last year, with British, Italian and French non-resident buyers in the top five.

Indian nationals were third, while Chinese buyers fell out of the top five as the country’s strict Zero Covid policy restricted travel.

Betterhomes expects a resurgence of Chinese investors in Dubai this year as the Asian nation opens up.

The brokerage last year started categorising buyers into residents and non-residents.

In 2022, Indian residents were the biggest property buyers followed by British investors and then Russians.

Going forward, Betterhomes expects “more of the same,” according to managing director Richard Waind. “Dubai is likely to continue to attract new residents and investors, ensuring transactions remain strong,” he said.

But Waind added that as interest rates remain at elevated levels, affordability will be impacted “and keep sales prices in the secondary market in check.”