Dubai continued to buck the trend and rise against the headwinds of inflation, supply chain issues and geopolitical situations, clocking impressive real estate growth numbers.

According to Asteco’s UAE Real Estate Report Q2 2022, both supply and demand were on the up in the emirate.

Real estate supply overview in Dubai

| Completed in Q1 2022 | Completed in Q2 2022 | Projected end of 2022 | |

| APARTMENTS No. of units | 6,000 | 7,000 | 22,000 |

| VILLAS No. of units | 260 | 520 | 3,300 |

| OFFICES Million sq.ft. | 0.3 | – | 0.85 |

The report said the first half of 2022 recorded a number of successful and noteworthy project launches, made in the wake of a renewed optimism in the real estate market. This was initially buoyed by a strongly performing secondary market.

While it has resulted in a slew of new projects, it has also led to many Tier-2 developers to revisit the feasibility of projects that were placed on hold.

The report warned that rising construction costs and supply chain issues represent increasing risks for developers and will likely result in delays for projects at pre/early stages of construction, but a majority of projects have been sold with construction milestone-linked payment plans, thus incentivising developers to complete projects on, or ahead of schedule.

Source: Asteco’s UAE Real Estate Report Q2 2022

Apartment supply picked up markedly, from 6,000 units in Q1 2022 to 7,000 in the second quarter. New villa handovers doubled, reaching 520 completed properties. However, there were no notable new office space handovers over the last three months.

Over the short-term, Asteco has revised materialisation rate. Another 25,000 residential units are expected for handover by the end of the year.

Majority of new deliveries were concentrated in upcoming developments including Damac Hills, Dubai Hills Estate, Wasl Gate and Port De La Mer.

Here is a complete overview of Dubai’s real estate market, factors promoting its growth, recent laws and more:

- The Expo 2020 effect on real estate

- How the Golden Visa will boost real estate sales in Dubai

- Dubai real estate market continues bull run in August 2022

- Dubai real estate report: Commercial rental values up by 10 percent

- Dubai real estate prices fall in July for the first time in 2022: Report

- How Dubai-based real estate platform Property Finder is using Golden Visas for talent acquisition

- Dubai’s new real estate laws explained

The Expo 2020 effect on real estate

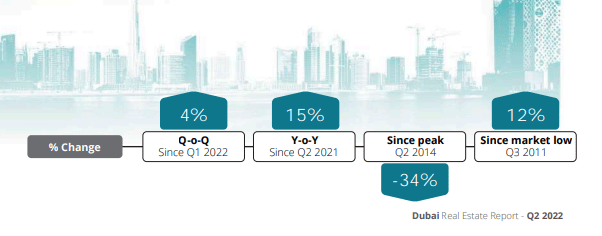

Rental rate growth continued with a similar momentum recorded over the last year. Average quarterly increases realised 4 percent for apartments, 6 percent for villas and 3 percent for offices, whilst annual growth stood at 15, 23 and 13 percent, respectively.

Demand for larger unit types, particularly villas and townhouses, with adequate useable outdoor areas (like balconies and gardens) and a strong community offering remained the focus for residents, thus driving rental and occupancy rates.

Quality apartments in prominent neighbourhoods also recorded an uptick in interest, and not only in established communities such as Palm Jumeirah and Dubai Marina, but also secondary locations with good community facilities such as those surrounding the Expo 2020 site.

Asteco believes the positive benefits of Expo 2020, including infrastructure upgrades and the repurposing of the site, will be felt across a wide range of sectors for years to come. The legacy plan of Expo 2020 Dubai and the Dubai 2040 Urban Master Plan are expected to open in October 2022. It is expected to become an independent free zone, as well as an economic and growth hot spot by featuring affordable housing and becoming a focal point for exhibitions, tourism and logistics.

The report said that while geopolitical developments and rising commodity and energy prices cannot be ignored, they have facilitated, rather than hindered, Dubai’s position as a safe haven.

Asteco expects rental rates to remain elevated in the second half of the year, but rental growth is expected to slow eventually as oversupply remains a lingering concern.

The report added that Downtown Dubai and Palm Jumeirah recorded the highest rental growth of 24 percent year-on-year, followed by Dubai Beach Residence and Dubai Marina (23 per cent). Dubai Hills (42 percent) Palm Jumeirah (41 percent) witnessed the highest growth in villa rental prices.

As many offices started returning to normal schedule, Business Bay area recorded the biggest office rental increase of 21 per cent, followed by 18 percent increase in the DIFC area.

How the Golden Visa will boost real estate sales in Dubai

While many international markets are still coming around from Covid-related lockdowns and restrictions, Dubai’s economy has made great strides.

It has recovered, boosted by higher oil prices and the revival in tourism and trade. It has resulted in exceptional transaction figures in the first half of the year, particularly with regards to off-plan properties and a marked increase in high-end/luxury residential unit sales.

According to the recent Henley Global Citizens Report, 4,000 high net worth individuals are expected to relocate to the UAE this year due to the advanced economic, social, legal and regulatory framework facilitating business, investment and residency.

Average apartment, villa and office sales prices rose by 4 percent, 4 percent and 2 percent over the quarter and 20, 26 and 19 percent annually.

Palm Jumeirah (44 percent) and Business Bay (34 percent) recorded the biggest increase in sale prices for apartments over the last year. Palm Jumeirah (52 percent) and Arabian Ranches (40 percent) witnessed the highest growth in villa sales prices compared to H1 last year.

Whilst demand for off-plan properties grew significantly, the increased cost of borrowing and the lack of affordable homes in the secondary market is squeezing out investors and end-users with more limited resources.

Strong inward investment is expected to continue on the back of advanced business reforms and government initiatives like the Golden Visa and efforts towards transitioning to a digital-driven economy.

The UAE Cabinet updated the long-term visa regulations in April 2022, stating that a Golden Visa (10 years) can be obtained when purchasing a property for AED2 million. The property can be completed or off-plan, and it can be mortgaged through specific local banks.

Asteco also believes the Dubai Land Department decision to make all real estate data publicly available is a sign of a maturing market and will strengthen transparency.

Dubai real estate market continues bull run in August 2022

Dubai real estate market recorded over AED1.2 billion on Tuesday, August 2, in line with the continued bull run in the emirate’s residential property market in recent months.

The Tuesday’s transactions included 396 sales deals worth AED 845.37 million, 110 mortgage deals of AED376.93 million and 11 gift deals amounting to AED96.55 million, data released by Dubai’s Land Department (DLD) showed.

The sales included 356 villas and apartments worth AED693.98 million and 40 land plots worth AED151.4 million.

The mortgage transactions included 94 villas and apartments worth AED286.71 million and 16 land plots valued at AED90.21 million.

The Tuesday’s property deal value, however, was lower than the AED 1.8 billion registered on last Wednesday, July 27.

The emirate’s market posted real estate transactions to the tune of AED 1.2 billion on Monday, July 25.

The Dubai real estate market has been on an upward spiral in recent weeks, recording transactions over $ 1 billion on several days, with the single day transactions hitting over AED 1.4 billion, AED 1 billion and AED 3.9 billion on July 22, 13 and 7 respectively.

Dubai witnessed a record AED 22.7 billion real estate sales transactions in June – highest sales figures in the last 13 years – and reaching almost 71 percent of the total 2021 sales volume.

For the April-June quarter, Dubai’s property market transactions amounted to AED 59.29 billion, up by 6.81 percent compared to Q1 2022.

Dubai real estate report: Commercial rental values up by 10 percent

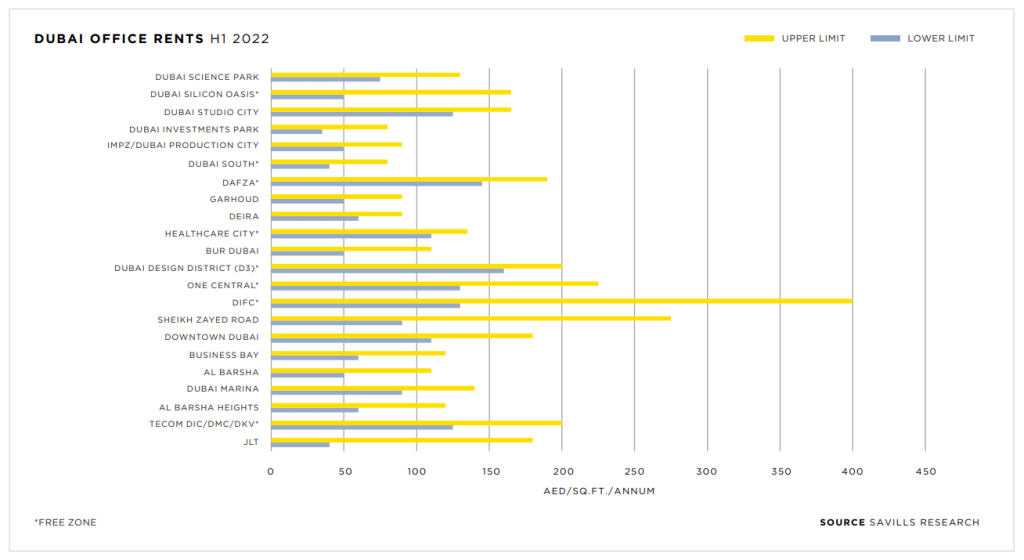

Dubai’s commercial rental values have shot up by 10 percent in the first half of 2022 over the same year-ago period, amid a rush for office spaces across prominent Grade A developments, real estate market consultancy Savills said.

The increase in rentals in the emirate was about 13 percent on a year-on-year basis.

According to Savills Dubai Office H1 2022 – market in minutes report, several markets are seeing rising rents, especially for ESG – environmental, social and governance-compliant spaces, as occupier demand continues to support prime end of the market.

The bulk of the leasing activity during the first six months of this year was observed across sub-markets such as DIFC, DWTC, DMCC, Dubai Media City and Dubai Internet City.

In terms of rental performance across office locations, the highest year-on-year gains were witnessed at Dubai Investment Park (35 percent), followed by Barsha Heights (29 percent), Dubai Production City (27 percent) and Deira (25 percent).

The conjoined locations of Dubai internet city – Dubai Media City – and Dubai Knowledge Village, Dubai Healthcare City and Dubai Design District largely remained stable, Savills said.

The report also cited an emerging trend of demand for flexible space options such as serviced office and co-working spaces, due to the combined effect of companies looking to reduce their capital expenditure spending and new market entrants looking to set up operations in the city.

“Most of the prominent flexible space operators across Dubai are recording high occupancy levels, with a few players reporting even 100 percent rise. They are now charting plans to further expand offerings in this space in the emirate,” the Savills report said.

Savills said occupier demand has been strong on the back of a buoyant local economy where companies are crystallising their expansion plans, and amid an influx of senior executives, business owners and High Net-worth Individuals (HNIs).

The report also said Dubai’s office utilisation levels in Q2 2022 were highest among Europe, Middle East and Africa cities tracked by Savills.

“An average of 80 percent of workers are back in offices in Dubai in some capacity, according to the recent Savills Prime Office Costs (SPOC) Report.

Paula Walshe, director, international corporate services, Savills Middle East, said businesses were increasingly acknowledging the importance of upgrading their existing spaces or moving to new places altogether that better suit their renewed requirements, which were altered by the pandemic.

“Many of our clients are finding better value in consolidating their operations, which is allowing them to sharpen their focus, while making significant savings against a backdrop of rising operational costs,” Walshe said.

According to Swapnil Pillai, associate director research, Savills Middle East, further diversification of the economy and emergence of new sectors such as virtual assets were contributing to the expanding occupier profile.

Dubai real estate prices fall in July for the first time in 2022: Report

Dubai’s real estate sector has seen record-breaking transactions in recent months, with price growth consistently up month-on-month.

But June bucked the trend when property prices fell by 0.31 percent – the first time it went down this year, according to Property Monitor.

Dubai property values now stand at AED1,019 per square feet, the report said, noting the downward movement “should not be an immediate cause of concern at this stage.”

“The Dubai property market’s resilience in the face of rapidly rising interest rates, inflation that seems to be on a runaway, and the strength of the Dirham due to the US dollar peg continues to wondrously amaze and battle any headwinds and downsides risks thrown at it,” the real estate intelligence company’s chief Zhann Jochinke said.

The report showed growing volume of transactions, reaching 8,865 sales in June, or a 38.8 percent increase year-on-year. Residential transactions led the increase, representing 89.3 percent of the total transactions.

Commercial property transactions were led by hotel apartments at 4.1 percent, land sales at 2.7 percent, and office at 2.6 percent, the report showed.

Average gross rental yields also performed well in June, rising to 6.3 percent – the highest level since October 2019. Yields for townhouses rose from 5.4 percent to 5.51 percent, while yields for apartments grew from 0.7 percent to 6.82 percent.

The report projects further growth in rental yields over the coming months, as the pace of sale price appreciation slows.

How Dubai-based real estate platform Property Finder is using Golden Visas for talent acquisition

Dubai-based real estate platform Property Finder is using the UAE’s Golden Visa scheme to attract and retain software and data engineers.

The move comes as the proptech firm struggles “to find product engineers who are keen to pursue a career in real estate,” Anuradha Challu, the company’s human resource head told Arabian Business.

“Beyond acquiring and retaining real estate experts, Property Finder’s talent strategy is heavily focused on attracting digital, product, analytics and engineering skills,” she said.

As part of their Golden Visa Program, Property Finder will assist software and data engineers, as well as some senior leaders to secure the 10-year residency visa – supporting them in the application process and covering the fees it entails.

Challu said the ultimate goal is “to attract and retain outstanding engineers and senior talent.”

“In the past few years, the UAE has become a hub for digital talent especially in the e-commerce, platform and tech space. It has pivoted its course to be among the prospective choices where digital talent wants to be, which means it is becoming a candidate driven, red-hot job market,” Property Finder’s Challu explained.

Dubai’s new real estate laws explained

Dubai recently announced two new real estate laws in July:

- Dubai has issued a new law to regulate the grant of Musataha rights on commercial lands in the emirate

- Dubai has introduced a new law to support the growth of real estate investment funds in the emirate

- Law regulating the grant of Musataha rights on commercial lands in the emirate –

A Musataha agreement grants its holder rights to develop a plot of land owned by another party for a defined period of time.

Issued by Dubai ruler Sheikh Mohammed bin Rashid Al Maktoum, the law “forms part of the emirate’s effort to consolidate its status as a preferred global real estate investment destination,” a statement on WAM said.

As per the new decree, the Musataha agreement creates a real property right that entitles its holder to construct a building or invest it, mortgage, lease, sell, or purchase a plot of land belonging to a third party for a period of up to 35 years.

The agreement can be extended to maximum of 50 years, and can be renewed given that a request is submitted two years ahead of the expiry, according to the statement.

The Musataha holder will be subject to a number of rules and regulation during the duration of the agreement – including registering it with the Dubai Land Department registry or that of the Dubai International Financial Centre. The holder should also obtain prior approval to the plot owner before changing the use of the commercial land. - Law supporting the growth of real estate investment funds in Dubai –

The law effectively creates a register for property investment funds, whose members will be given certain privileges to assist them in their investment activities in emirate’s real estate market.

Issued by Dubai Ruler Sheikh Mohammed bin Rashid Al Maktoum, the new law is part of the emirate’s ambition to be a “global real estate investment destination and attract global property investments funds,” according to a statement on WAM.

The new register includes real estate investment funds licensed and regulated by government bodies, as well as those in private and free zones, including the Dubai International Financial Centre. It covers all real estate in Dubai as well.

Applicants to the register should have real estate assets of AED180 million or above.

The new law also created a dedicated committee to identify areas and properties that funds are allowed to invest in. It will also see Dubai Land Department appoint a valuation specialist to determine the value of properties owned by the funds.