The UAE unemployment insurance scheme is now mandatory for all workers from January 1.

First announced in October 2022, the plan will cover workers who lose their job for up to AED20,000 per month for three months from the date of unemployment.

All workers in the country need to sign up for the mandatory unemployment insurance policy on their own or face fines for failing to do so.

Prices for unemployment insurance range from AED5 to AED10 per month, and are available from a select group of insurance agencies.

Everything you need to know about the UAE’s unemployment insurance scheme

- 60,000 sign up for UAE unemployment insurance in 2 days

- UAE workers to face fines for failing to sign up for unemployment insurance

- UAE announces mandatory unemployment insurance grace period for employees

- UAE exempts freezone employees from unemployment insurance

- UAE unemployment insurance: 10 things you need to know

- UAE announces start date of pioneering Unemployment Insurance Scheme

60,000 sign up for UAE unemployment insurance in 2 days

Sixty thousand UAE employees signed up for unemployment insurance in first two days reports state news agency WAM.

The programme was implemented through a federal decree, which relates to unemployment insurance that does not incur any additional costs for employers.

The scheme aims to provide financial security to workers and professionals in the public and private sectors in case of job losses.

UAE unemployment insurance

In the first two days, 86 percent of participants chose to sign up via the website, one of seven channels provided by the Dubai Insurance Company, which represents the insurance complex that is in charge of providing insurance services against unemployment.

It is mandatory for all employees of the public and private sector to be registered for the unemployment insurance scheme, employees not registered will be subject to fines.

Other subscription channels include the smart application of the insurance complex, self-service kiosks, businessmen service centres, Al Ansari Exchange, and smartphone applications of banks in the country, as well as telecom bills.

Ninety percent of participants chose to subscribe to the scheme annually.

This option is given to two categories of individuals who are covered by the insurance.

Two categories of unemployment insurance are available, depending on the worker’s salary.

UAE unemployment insurance category A

Category A costs AED5 per month. It can be paid monthly, quarterly or annually.

This category of insurance is open to any employee who has a monthly salary of AED16,000 a month or below.

In the event of losing their job UAE workers would be entitled to 60 per cent of their average basic salary, calculated on an average of the six months leading up to unemployment.

The sum is capped at AED10,000 per month and is payable for three consecutive months.

The limit on unemployment insurance on this category, then, would be AED30,000 ($8,169) to be paid out on the annual fee of AED60.

UAE unemployment insurance category B

Category B costs AED10 per month. It can be paid monthly, quarterly or annually.

This category of insurance is open to any employee who has a monthly salary above AED16,000 a month.

In the event of losing their job UAE workers would be entitled to 60 per cent of their average basic salary, calculated on an average of the six months leading up to unemployment.

The sum is capped at AED20,000 per month and is payable for three consecutive months.

The limit on unemployment insurance on this category, then, would be AED60,000 ($16,338) to be paid out on the annual fee of AED120.

Insured amounts will not be applicable if the employee was dismissed for disciplinary reasons under the Labour Relations Law and Human Resources Law, in addition to any applicable legislation.

The exempted categories for the scheme are investors or owners of establishments, domestic workers, temporary contract workers, juveniles (under 18 years), and retirees who receive a pension and joined a new job.

According to the Insurance Pool website, in order to be eligible for compensation in the UAE, the insured must meet the following criteria:

- There must be a minimum subscription period of 12 consecutive months for the insured in the scheme. Provided that there is no interruption in the subscription for three consecutive months

- The Insured was committed to pay all the insurance premiums due on time

- The Insured proves that the reason of unemployment is not due to resignation

- The Insured may not be dismissed for disciplinary reasons under the Labour Relations Law and the Human Resources Law of the federal government in addition to any applicable legislation

- Submit the claim within 30 days from the date of loss of the work relationship or the settlement of the labour complaint referred to the judiciary

- The Insured worker should not have an existing complaint related to the absence from work.

- The Insured shall not be entitled for compensation if there has been fraud or deceit involved in his claim or if the establishment where they work for is fictitious

- The Loss of Employment should not be the result of non-peaceful labour strikes or stoppages, whether they result in harm or not.

UAE workers to face fines for failing to sign up for unemployment insurance

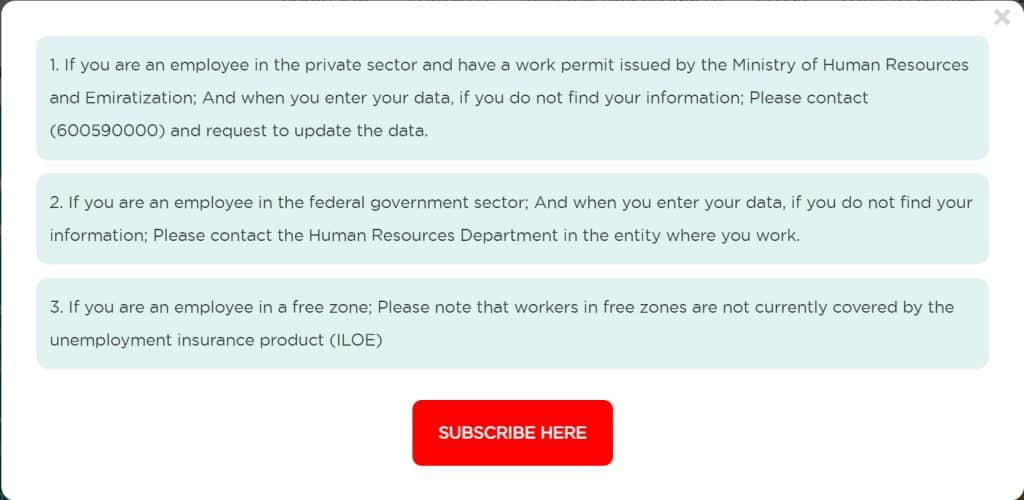

UAE introduced mandatory unemployment insurance for citizens and expats starting January 1, 2023. It is mandatory for all employees of the public and private sector to be registered for the unemployment insurance scheme, employees not registered will be subject to fines.

There is a grace period to subscribe to the unemployment insurance scheme, those not registered at the end of the grace period will be subject to fines starting June 30.

The UAE’s Ministry of Human Resources and Emiratisation (MoHRE) first announced the Unemployment Insurance Scheme for all government and private sector employees back in October and it has come into effect starting Sunday, January 1.

The MoHRE has now issued a video guide on social media to explain the benefits and costs of the UAE unemployment insurance.

Two categories of unemployment insurance are available, depending on the worker’s salary.

As has been previously reported on Arabian Business, the insured compensation will not be given if there has been fraud or deceit involved in the claim or if the listed place of employment is fictitious.

Fines and penalties will be issued in this case. If the individual finds a job during the period of compensation entitlement, the payment will cease.

UAE employees can use the following subscription channels:

- Insurance Pool’s website and its smart application

- Bank ATMs and kiosk machines

- Business service centres

- Money exchange companies

- du and Etisalat

- SMS

UAE announces mandatory unemployment insurance grace period for employees

The UAE has announced that there will be a grace period for workers to sign up for the country’s new mandatory unemployment insurance scheme.

Last year, the UAE announced the launch of a new insurance plan for unemployed government and private sector workers. The plan will pay employees 60 percent of their basic salary for up to three months from the date of employment. The scheme caps out at AED20,000 a month.

The scheme came into effect on Sunday, January 1, 2023, and is mandatory for all employees in the UAE. However, authorities have now revealed a grace period for sign-up.

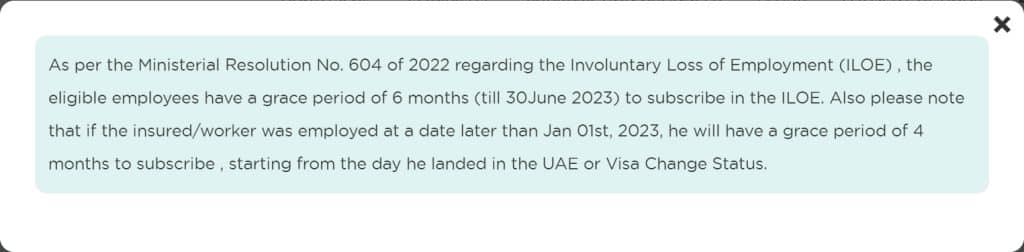

“As per the Ministerial Resolution No. 604 of 2022 regarding the Involuntary Loss of Employment (ILOE), the eligible employees have a grace period of 6 months (till 30 June 2023) to subscribe in the ILOE,” the official portal for the scheme read.

In addition, workers who change their visa or begin work in the UAE after January 1, 2023, will have a grace period of four months to subscribe for unemployment insurance.

Workers who have a basic salary of AED16,000 or less will need to pay a monthly premium of AED5, or AED60 per year. The compensation for this plan will not exceed AED10,000 per month.

Workers with a basic salary exceeding AED16000 will need to pay a monthly premium of AED10, or AED120 per year. The compensation for this plan will not exceed AED20,000 per month.

In both cases, unemployment insurance pay-outs will last for three months from the start of unemployment.

Insured amounts will not be applicable if the employee was dismissed for disciplinary reasons under the Labour Relations Law and Human Resources Law, in addition to any applicable legislation.

UAE exempts freezone employees from unemployment insurance

UAE introduced mandatory unemployment insurance for citizens and expats starting January 1, 2023. It is mandatory for all employees of the public and private sector to be registered for the unemployment insurance scheme, employees not registered will be subject to fines.

However, there are certain categories exempt from the unemployment insurance scheme:

- Employees working in Freezones

- Investors (Owners of companies they work at)

- Domestic helpers

- Temporary contract workers

- Juveniles under the age of 18

- Retirees entitled to pension and joined a new job

Free zone employees who try to sign up on iloe.ae will receive an alert stating “If you are an employee in a free zone; Please note that workers in free zones are not currently covered by the unemployment insurance product (ILOE).

For those eligible, compensation benefits include:

- The Monthly compensation is 60% of the average basic salary over the most recent 6 months prior to the Involuntary Loss of Employment

- For category A: Maximum claim benefits: AED10,000 per month

- For category B: Maximum claim amount: AED20,000 per month

- Maximum compensation for any one claim: 3 consecutive months

- Maximum period of benefits: During the Insurance Period over the entire work life of the Insured in the United Arab Emirates the aggregate Claim Payment shall not exceed 12 monthly benefits (regardless of the number of Claims submitted

UAE unemployment insurance: 10 things you need to know

Last year, the UAE announced the launch of a new insurance plan for unemployed government and private sector workers. The plan will pay employees 60 percent of their basic salary for up to three months from the date of unemployment. The scheme caps out at AED20,000 a month.

The scheme came into effect on Sunday, January 1, 2023, and is mandatory for all employees in the UAE.

Here are the 10 things you need to know about the new unemployment insurance scheme:

- How to apply: Visit the iloe.ae website, click subscribe now and follow the steps

- Cost: AED5 per month for those earning a basic salary of AED16,000 or less, AED10 per month for those with a salary higher than AED16,000

- Deadline: Six months until June 30. Workers who change their visa or begin work in the UAE after January 1, 2023, will have a grace period of four months

- Fine for non-subscripton: AED400

- Fine for missing instalment premium: AED200

- Exempted categories: Freezone employees, investors/company owners, domestic helpers, temporary contract workers, juveniles and retirees

- Subscription channels: Insurance Pool website and its smart application, bank ATMs and kiosk machines, business service centres, money exchange companies, du and Etisalat, SMS

- Minimum subscription period: 12 months for eligibility of pay-out

- Maximum compensation: Three months

- Non-applicable: Fraud or deceit involved in his claim or if the establishment where they work for is fictitious, existing complaints, result of non-peaceful labour strikes or stoppages

UAE announces start date of pioneering Unemployment Insurance Scheme

The UAE will roll out the new Unemployment Insurance Scheme from the New Year, which will offer up to AED20,000 per month to eligible employees in the federal government and private sector.

The new insurance scheme, announced by the Ministry of Human Resources and Emiratisation (MoHRE), will be opened to UAE nationals and residents.

The new scheme will commence from January 1, 2023.

It aims to protect employees by offering them maximum 3-month cash compensation as long as they did not resign or were dismissed for disciplinary reasons.

The insurance scheme, which will be offered under two categories, will have a marginal subscription fee and variable cash compensation.

In the first category, the scheme will be offered to employees with a basic salary up to AED16,000. The insurance cost under this category will be AED5 per month and monthly cash compensation will reach up to AED10,000.

The second category is for employees with a basic salary of more than AED16,000.

The monthly insurance cost for this category will be AED10. The monthly cash compensation for this category can reach up to AED20,000.

The compensation will be paid if a user has subscribed to the scheme for at least 12 consecutive months.

Investors or owners of establishments, domestic workers, employees with temporary employment contracts, juveniles under 18 years of age, and retirees with a pension and have joined a new job are not eligible to join this insurance scheme.