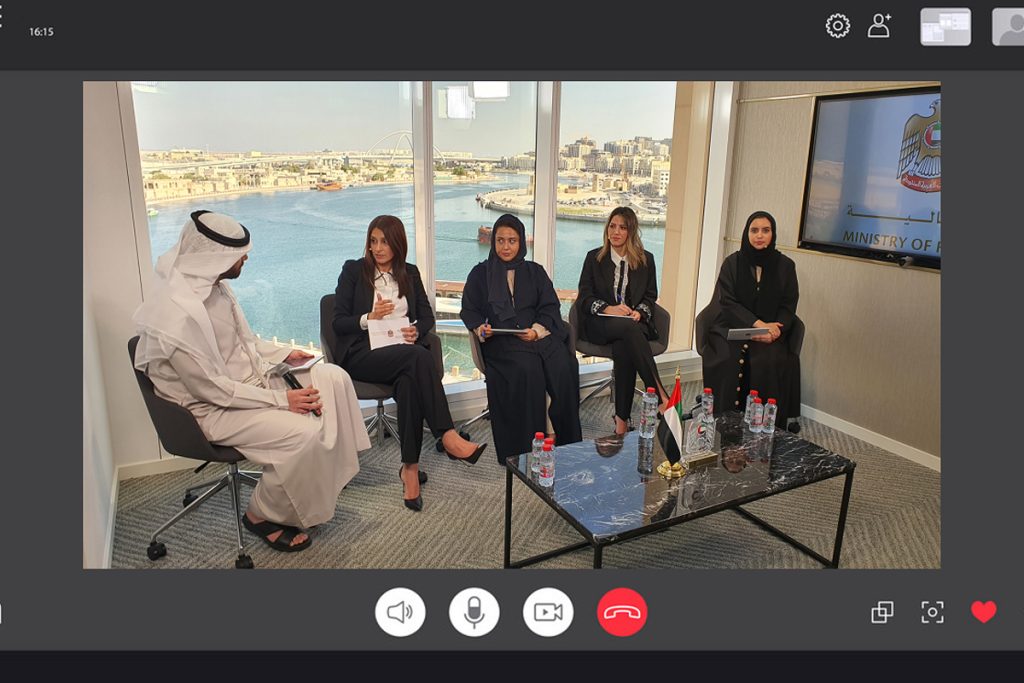

The UAE Ministry of Finance held a virtual session, highlighting the features of the nation’s corporate tax regime.

This included explaining tax rates, the corporate tax administration for resident and non-resident persons in the UAE, unincorporated and incorporated partnership, and the treatment of family foundations and trusts, the authority said in a statement on Tuesday.

UAE corporate tax rules

The virtual session, which saw participation from over 800 business representatives, tax experts, and other professionals in the industry, also addressed persons exempt from the tax, the status of companies operating in free zones, and corporate tax administration, such as registration, financial statements, maintaining financial records, fines, transfer pricing, tax loss relief and others.

In addition, the Ministry of Finance spoke about corporate tax timelines, which extend for over two years to allow preparation; general anti-abuse rules; support for small businesses.

The statement added that the authority also listed out the roles and responsibilities of the Ministry of Finance as well as the Federal Tax Authority (FTA) in implementing the new tax regime.

Corporate Tax Public Awareness Programme

This is the third session of the Corporate Tax Public Awareness Programme, however, it is the first to be held virtually.

The programme was launched by the Ministry to raise awareness about the new tax, after the Federal Decree-Law on Taxation of Corporations and Businesses (the “Corporate Tax Law”) was issued last month.

The programme was launched to add on to the Ministry’s commitment to reaching the largest possible number of entrepreneurs, tax experts, and representatives of companies operating in all emirates of the UAE, the statement said.

It was formed in order to “introduce them to the new law and help them understand the details and implementation of the new tax regime to ensure compliance,” the statement added.

The session saw participation from tax experts from the Ministry of Finance, including Shabana n Begum, the executive director of the tax policy sector; Fatima Al Sheikh, the director of tax policies and legislations; Thuraya Al Hashemi, the director of the international tax department, and Rasha Hajj Hussein, an expert on tax policies and legislations.