Saudi developer Umm Al Qura for Development and Construction said on Sunday it will proceed with an initial public offering (IPO) and list its shares on the Saudi Exchange’s main market.

The IPO proceeds are to be deployed for funding the infrastructure, land settlements, and development of the MASAR Destination, a major Makkah redevelopment project valued at $26.66 billion (SAR 100 billion).

The company said it plans to offer 130.8 million new shares, or 9.09 per cent of its post-increase capital, Reuters reported.

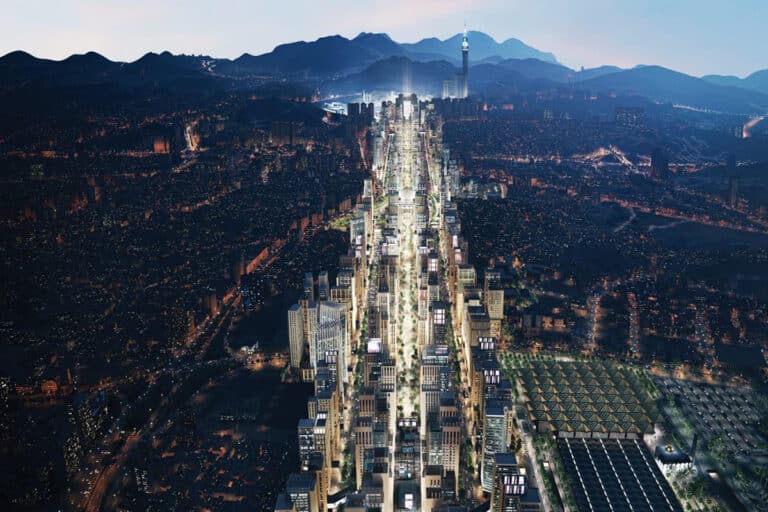

Spanning 1.2 million square meters, MASAR aims to enhance Makkah’s infrastructure with hotels, residential units, retail spaces, and cultural centres, according to its website.

The Saudi Exchange granted conditional approval on December 8, 2024, while the Capital Market Authority (CMA) approved the company’s IPO on December 24, 2024, allowing it to raise funds for land settlements, infrastructure, and project expansion.

Umm Al Qura was established in 2012, and is backed by major Saudi entities, including the Public Investment Fund of Saudi Arabia (PIF) and the General Organization for Social Insurance (GOSI).