Gold prices are expected to rally further – both globally and in India – in the wake of the US Fed Chairman raising concerns on inflation and damages to the US economy due to the ongoing banking crisis, raising apprehensions of denting retail demand in the ongoing festival season in India, market players said.

This, in turn, could lead to further fall in India’s import of the yellow metal. The UAE is the second largest exporter of gold to India, after Switzerland.

The country’s gold imports, which have been on a downward spiral since December due to rising prices, plunged by 45 percent in February over the corresponding month of 2022 to $2.63 billion.

India’s falling imports

Industry insiders, however, said the March import figures of the precious metal could be better because of the anticipated festival demand in India.

Gold imports by India during April-February this fiscal saw a fall of 29.71 percent to $31.72 billion, according to latest data.

Gold prices gained $7 dollars on Thursday to hit about $1,977 for an ounce.

In India, the price of the yellow gold is expected to hit a high of upto $754 per 10 gm in a near-term basis.

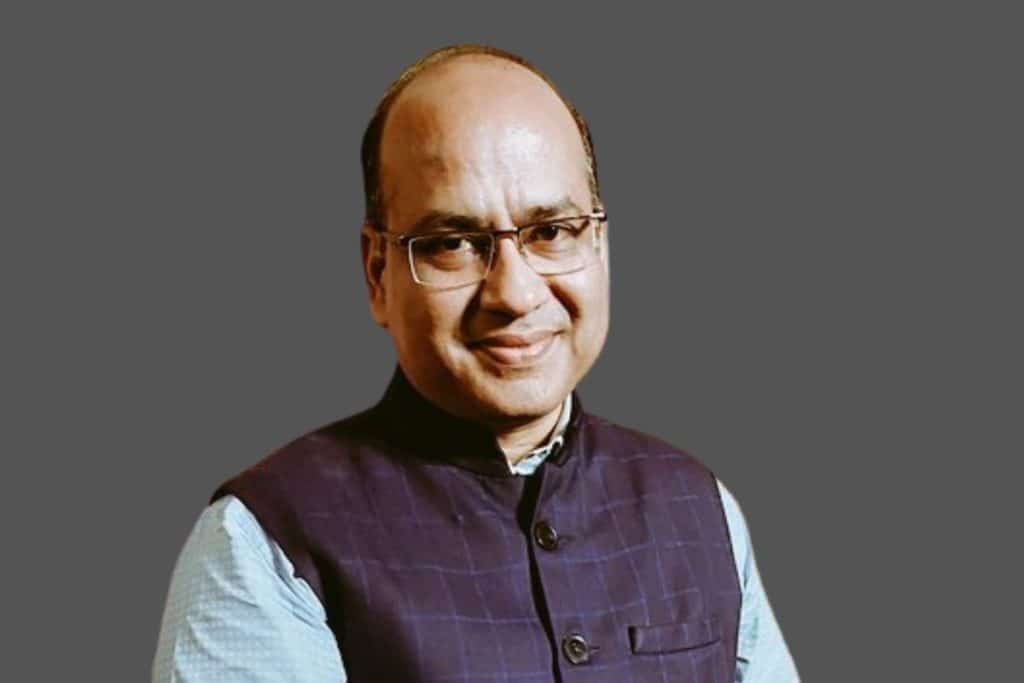

“Gold prices are expected to further rise due to fear factor in Fed commentary,” Surendra Mehta, National Secretary of Indian Bullion and Jewellers Association (IBJA), told Arabian Business.

“All seems not well with the US banking system. Inflation leads to recession and this will further boost gold prices,” Mehta said.

The industry body top official also expressed apprehensions of the rising gold prices seriously impacting retail sales in India.

“It is difficult to digest the 8 percent spurt in gold price in just 10 trading sessions for consumers and this has stopped them from venturing to retail jewellery shops,” Mehta said.

Manoj Jain, a commodity market expert and Director of Prithvi Finmart, said gold prices are expected to show strength in Thursday’s trading session as the concerns about inflation and economic crisis could support safe-haven demand for precious metals.

“Gold could test $1988 [per ounce] in a day or two and could test $2050 in the short term,” Jain told Arabian Business.

Ajay Kedia, managing director of Kedia Commtrade and Research said the current scenario appears to be favourable for a gold rally similar to the one that occurred during the 2008 global financial crisis, which saw a gain from $680 to $1920 per ounce over a three-year period.

“With the specter of banks failing, recession looming, and central banks buying gold, a somewhat 2008-like situation seems to be emerging. We can see gold prices easily test $2200 in the near term – next one year,” Kedia told Arabian Business.

Kedia also said they have also revised the gold price targets in India.

“In India [gold] prices could test the $803 [per 10 gm] level, while till year end it can test $778 – revised from the earlier target of $754 looking at current fundamentals,” Kedia said.

Kedia, however, said gold imports could see a rise in the coming months as demand for bullion could see a jump due to the rising price trend.

“Investors in India always love gold when it (price) rises,” he said.

Kedia said gold demand in recent months was hurt by higher costs and recession fears as well due to lack of major festivals and marriages.

“This week marks the beginning of the festival season in India, and India has a history of purchasing gold on the rise. As a result, we expect that the festive mood, a correcting equity market, and a combination of recession and anxiety will boost gold demand in 2023,” he said.

Mehta, however, said there is no increase in export of gold jewellery due to non availability of gold for export and lower duty drawback.