UAE-based Ziina has announced its latest funding round of $7.5 million, which will be used to launch its new wallet service and fuel expansion into Saudi Arabia.

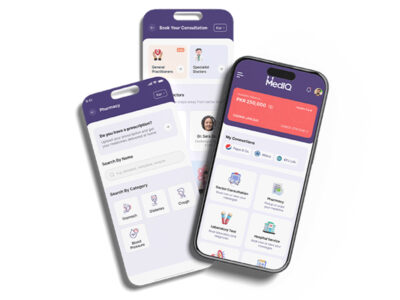

The country’s first licensed social peer-to-peer (P2P) payment application, which is backed by Y-Combinator (YC), is aimed at simplifying payments – users can send and receive money with just a phone number, with no IBAN or swift code required.

The new round includes investors from the Middle East, US and global fintech founders.

Faisal Toukan, CEO and co-founder of Ziina, said: “We are thrilled to have onboarded our latest group of partners and are grateful for the continued support from our existing investors.

“This round will fuel our expansion plans into Saudi Arabia and support the launch of our highly anticipated wallet feature, which we will be introducing along with our new banking partner shortly. We will also use this financing to continue to attract top global talent to further elevate Ziina’s product and bring the application to the centre of our users’ daily finances.”

Founded in 2020 by Faisal Toukan, Sarah Toukan, and Andrew Gold, the young start-up, which launched operations out of Dubai’s In5 tech start-up incubator, with a license issued by TECOM is the latest addition to the Middle East’s fintech ecosystem and is capitalising on the region’s rapid adoption of fintech friendly regulation.

Faisal added: “In the future, we want Ziina to be the centerpiece of people’s finances, inspiring our users to take control of their money and offering them new possibilities to grow their wealth.”

Ziina’s latest seed round is led by Avenir Growth Capital and San Francisco-based Class 5 Global, with participation from Wamda Capital, FJ Labs, Graph Ventures, Goodwater Capital, Jabbar Internet Group and Oman Technology Fund’s Jasoor Ventures.

The round also includes Zinal Growth, the investment fund of Guillaume Pousaz, CEO of Checkout.com; Krishnan Menon, the CEO of Bukukas; Marc Atiyeh, CEO of Pawp; as well as executives from Paypal and Venmo.

This adds to a roster of fintech operators from Revolut, Stripe, Brex, Notion, and Deel that joined Ziina’s previous round.