Investors who put money into Non-Fungible Tokens (NFTs) during its peak, are now highly likely to holding on to potentially worthless tokens.

According to a new report by dappGambl, shocking data reveals that over 95 percent of NFT collections now have no value and those that do, have significantly plummeted.

The emergence of digital collectibles took the world by storm, these digital assets covered a wide scale of industries including fashion, art, real estate, music, and sports. The ‘investment’ factor of the digital asset involved it being unique and irreplecable, allowing investors to own a share of the asset.

In August 2021, the monthly trading volume of these digital assets was recorded at a whopping $2.8 billion. Now? It stands at a mere 3 percent as compared to its peak.

NFT market volatility

According to the latest data, the market seems to have crashed, with several NFT projects seeking buyers in a market with a negative outlook. From the 73,257 collections identified in the report, 69,795 were found to have a market cap of 0 Ether (ETH).

This means, over 23 million NFT holders now have worthless investments.

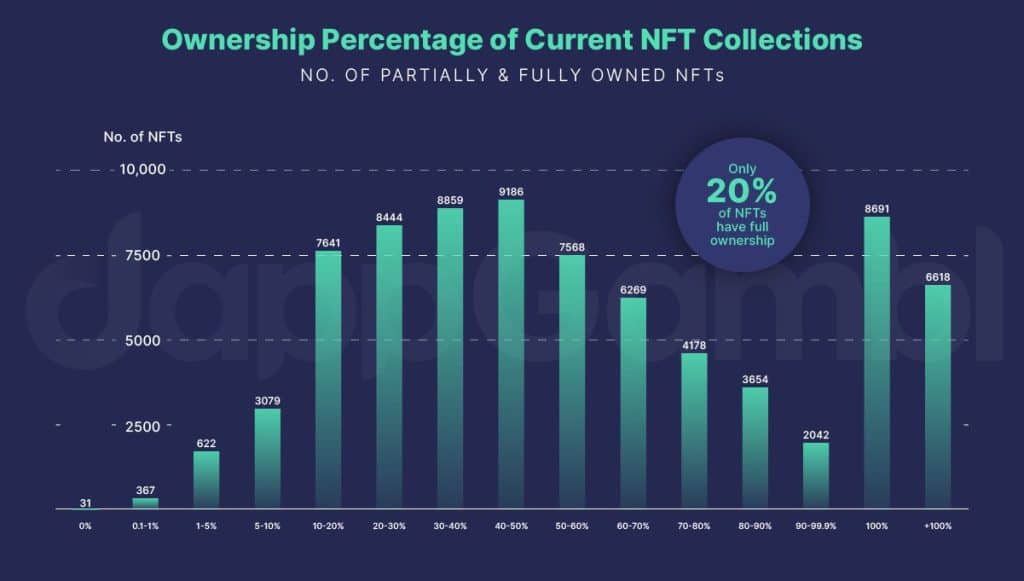

In the market that consists of millions of blockchain art projects, some sold at significantly high values, only 20 percent have full ownership. Over 79 percent of all collections have remained unsold. A classic example of supply overflowing demand within the highly volatile market.

As a reflection of the state of the market, over 41 percent are priced between $5 to $100 and over 18 percent are worth $0.

“MacContract on Ethereum has a floor price of $13,234,204.2, but its all-time sales is only $18. This stark discrepancy between listed floor prices and actual sales data exposes a significant issue in the NFT market – inflated valuations that don’t reflect genuine buyer interest or real-world transactions,” the report said.

“Such disparities reveal a speculative nature in parts of the NFT market, where exorbitant prices can be set by sellers without any bearing on tangible, real demand,” explained the report.