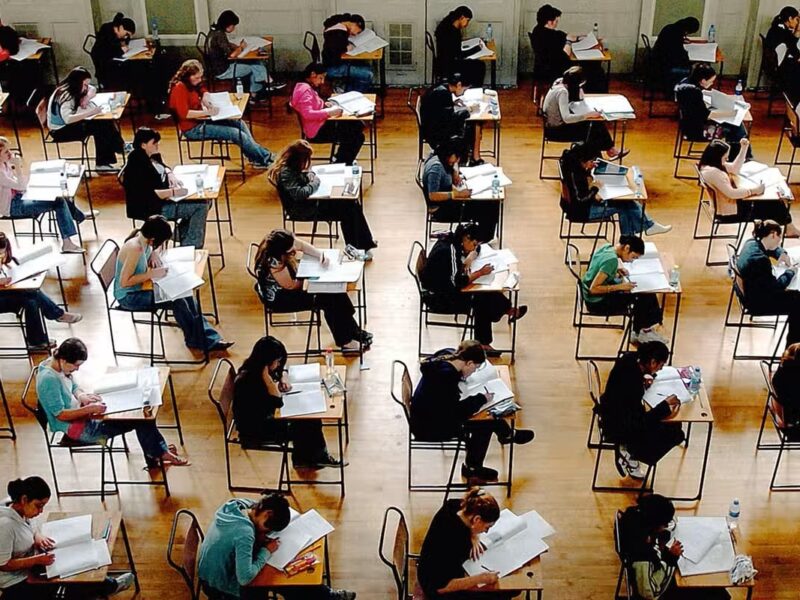

A buzzing market |~|HusseinOmar.gif|~|Omar Hussein, partner business manager at HP ProCurve Networking, Middle East|~|There is a real buzz around the Middle East market for network solutions. Customers of all sizes are investing heavily in advanced infrastructure as the realisation dawns that the network truly is the heart of any IT system. Given the opportunities that exist in the Middle East, it is no surprise to see major vendors engaging in a highly competitive battle, as they attempt to roll out channel programmes that will not only attract the best partners in the region, but also keep them loyal and provide them with a platform for decent profitability.

Networking technology has come a long way in the last decade and channel partners have turned their attentions to this fast-growing market segment in increasing numbers. Networks are the glue that brings IT and communication systems together and new developments such as voice over IP and wireless technologies are helping to drive the boom in demand for solutions across the Middle East.

“The market in this region is growing aggressively — even faster than the US and Europe. In the Middle East there are more people ready to invest in networking solutions,” says Omar Hussein, partner business manager at HP ProCurve Networking, Middle East.

While Cisco remains the dominant vendor in the networking arena, there is a bevy of vendors nipping at its heels and attempting to grab market share in the Middle East. 3Com continues to pose a challenge to Cisco and has now started turning its attentions more fully to the enterprise sector. HP also wants in on the network goldmine and is pushing its ProCurve networking kit hard in the region.

With major vendors fighting hard for market share, channel strategy is playing a pivotal role in determining success or failure. Vendors such as Cisco already offer a highly developed channel programme in the Middle East, categorising partners carefully and helping to focus them on emerging technology areas. The success of Cisco’s channel programme and the breadth of its Middle East reseller base mean that rival vendors need to come up with something pretty special to tempt partners away.

||**||Growing ProCurve |~|Ivan_Kraemer.gif|~|Ivan Kraemer, sales and marketing director at HP ProCurve Networking, Middle East, Africa, and the Mediterranean|~|HP looks up for the challenge as it embarks on an expansion of its ProCurve partner programme to include more resellers and boost channel reach for its networking products into the small and medium business (SMB) sector.

A new three-tier channel programme is ready to go in the region, categorising resellers into professional, specialist and elite categories. The professional partners will push hardware-focused solutions into the SMB market, while middle tier specialist partners are expected to develop solution-selling skills and target the midmarket.

“Specialist partners will earn a higher margin based around the fact that they have solution-selling skills and can implement technologies such as IP telephony and video-on-demand systems,” explains Hussein.

“HP ProCurve’s elite partner status will offer a range of additional channel benefits to partners that demonstrate solid commitment to our networking product portfolio. Elite partners will be very loyal and focused on pushing HP solutions.

“They will actively drive the HP brand into large accounts, rather than just offering a solution from any vendor,” adds Ivan Kraemer, sales and marketing director at HP ProCurve Networking, Middle East, Africa, and the Mediterranean.

Kraemer reckons ProCurve will need one elite partner in the smaller Middle East markets such as Qatar and Bahrain, and up to three or four in larger markets such as the UAE and Saudi Arabia. In the specialist tier Kraemer reckons HP will recruit up to ten partners in each large market and three or four in each of the smaller countries.

While major vendors such as Cisco, HP and 3Com can talk long and hard about the superiority of their products over competitors, what the channel really wants to hear about is margins, rebates, incentives, discounts, support, lead generation campaigns and ongoing training. These factors are much more important to your average channel player than the technical intricacies of the latest whizzy router or switch.

||**||Cisco’s Structure |~|Ghoul.gif|~|Tarek Ghoul, regional channel manager at Cisco|~|Cisco certainly has channel breadth in the region with hundreds of partners signed up at its basic registered level. Above this category, the network behemoth offers a three tier certified programme supplemented by various options for partners to specialise and focus. Schemes such as the value incentive programme (VIP), opportunity incentive programme (OIP) and solution incentive programme (SIP) have also been introduced by Cisco to help sustain channel profitability.

The need to safeguard channel margins remains a dilemma for all vendors that have an expansive channel base. If too many partners are fighting against each other in a given market, there is always the danger that they will cut margins to the bone and discount heavily in anticipation of rewards further down the line just to secure a specific project. It is a problem that Cisco is working hard to avoid.

The Cisco certified partner programme is split into three levels: premier, silver and gold. To move up the channel ladder, partners must meet minimum requirements in terms of sales skills, technical skills and specialisations. Cisco also measures customer satisfaction closely to gauge the performance of channel partners in the market.

“We have very stringent requirements at every level of partnership,” says Tarek Ghoul, regional channel manager at Cisco. “So when you are talking about companies attaining a specific status, you know that it is a real reflection on that partner’s level of investment.”

Cisco is also rolling out its SMB select partner programme in the region, highlighting the growing importance of small and medium businesses (SMBs) as a market sector that will drive future sales growth. Seven partners have already signed up for the programme in the UAE with a couple more in Saudi Arabia also enrolled.

While Cisco is working hard to accelerate sales in the SMB market, networking rival 3Com is devoting more resources to crack the enterprise account market in the Middle East. 3Com is building relationships with a number of enterprise focused channel partners. These partners will have platinum status within 3Com’s channel programme, meaning that they will have a direct buying relationship with the vendor.

||**||3Com fighting back |~|Khankhalid.gif|~|Khalid Khan, marketing manager MENA at 3Com|~|Below this level, 3Com has a standard two-tier reseller channel and claims to sell product to between 500 and 600 resellers across the region every month. With value and volume programme tracks available, 3Com’s scheme offers opportunities for a wide range of channel partners.

“When we look for partners, we recruit a number of potential companies and then filter them over time. Until you have worked with partners for some time, it is very hard to understand their individual strengths. We plan to classify partners differently in the future and this will make the filtering process more efficient,” says Khalid Khan, marketing manager Middle East and North Africa (MENA) at 3Com.

All networking vendors are quick to claim that their channel programme offers partners the best opportunity to make a reasonable margin. However, all vendors are also quick to apply the same caveat to their margin claims; namely that partner profitability is dependent on the level of commitment a partner puts in and their propensity to invest in building up their skill set.

Hisham Amili, general manager at Mitel Networks GCC, a provider of converged data and telecommunications networks, elaborates: “The set up costs of the networking business in terms of having qualified engineers, offering ongoing training and recruiting credible business managers is a significant investment. These are all vital areas and require a high level of dedication and expertise.”

Vendors are desperate for more of their channel partners to become fully-fledged solutions providers. This typically requires a strong vendor-led training programme and a genuine desire among channel partners to focus on either specific technology areas such as wireless and security or specific vertical markets such as healthcare or hospitality.

||**||Communications convergence|~|AtkinChris.gif|~|Chris Atkin, GCC sales director at Viewnet Technologies|~|Channel specialisation will play a vital role in sustaining the growth momentum that the networking sector is currently experiencing in the Middle East. As more and more companies look to deploy next generation network infrastructures, they will increasingly look for integrators that can provide solutions tailored to their specific business requirements.

What is not in doubt is the fact that investment in network solutions is rocketing across the region. A recent report released by the Saudi General Investment Authority claimed that US$1.8 billion had been invested in data and telecommunications networks in the Kingdom during the first half of 2005 — an increase of US$900m year-on-year.

The fact that this report focused on both data and telecommunications networks is telling. The other major factor driving the networking market to the next level of development is the strong demand for converged solutions. Networking and communications technologies are becoming intertwined to such an extent that it is sometimes difficult to view the two areas as separate entities.

As the worlds of communication and network technologies fuse together, partners from both sides of the fence are chasing the same business opportunities more and more. Voice integrators and data integrators are both working hard to communicate to customers exactly why their experience and background makes them the best partner when it comes to installing a converged network.

“Most people entering the networking arena come from a data background, but we have a particular advantage. Voice is very different to handling data: there can be no glitches or delays. It has to work in real-time,” says Chris Atkin, GCC sales director at Viewnet Technologies, a company with a strong communications background.

||**||Value addition in the midmarket |~|dkroy.gif|~|DK Roy, manager at Almasa Networking Solutions|~|Atkin believes that the networking channel is still in the early stages of development in this region and that opportunities remain for professional companies to carve out a strong market position.

“In Europe and the US there are a handful of companies leading the market. The Middle East is still a young market and the channel is still evolving to meet the demands of customers,” he adds.

While converged networks remain more relevant to the requirements of large accounts, the demand for networking products in general has expanded rapidly to cover a much wider customer footprint. SMBs, small offices, home offices and even individuals are all potential customers for a slew of vendors plying their trade at the low end of the market.

“We see the most growth in the small and home office and SMB sectors,” says Hishamul Hasheel, technical sales manager MENA at US Robotics. “We understand both SMB needs and the nature of these customers much better than larger vendors in these markets.”

“Our products are largely plug-and-play devices, but resellers have the opportunity to provide value-add services or even offer complementary products,” says Sumit Kumar, regional sales manager Middle East and North Africa at US Robotics.

At the lower end of the market, value-added distributors are playing a vital role, helping the wider reseller community take networking products to market. Almasa’s networking solutions business unit offers US Robotics as part of its best-of-breed vendor portfolio.

“When a reseller talks to us, they need to feel the same kind of transparency they would receive when talking to the vendor. Then, when we talk to the vendor, we have to make sure they understand what our partners need to win contracts. We are their local eye,” explains DK Roy, manager at Almasa Networking Solutions.

Value-added distributors operating in the networking arena also play a key role in the provision of services across the region. Many resellers do not have the necessary scale to build up their own professional services capability. Step forward the value-added distributor, which can build up a centralised resource for all resellers to leverage.

“If our partners have a project, we get involved with it, our engineers represent them, meet with the end users and help advise and design the most suitable solution,” explains Venu Menon, divisional director at Online Distribution Middle East. The network market is booming and distributors, integrators and resellers are all chasing a piece of the action.

||**||