Leading buy-now-pay-later (BNPL) provider Tabby has revealed that customers in the UAE do not have a new minimum order value, except when shopping on certain partner brand websites.

“Tabby does not have a new minimum threshold for customers. In rare cases partner brands may impose a minimum basket size,” Tabby clarified to Arabian Business in a statement.

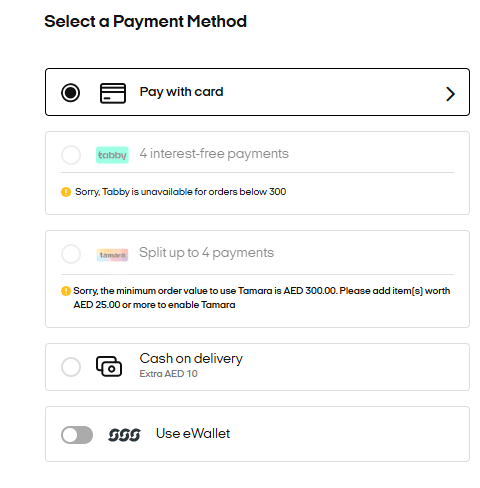

Arabian Business first noticed an AED300 cap on orders on the ‘payments’ page of Sun & Sand Sports’ online shopping website.

Previously, customers could split payments for purchases of lower values, but the new threshold indicates a strategic repositioning of these services towards larger transactions.

In December 2024, Tabby removed its late fees on its Pay in 4 payments in Saudi Arabia. This change aligns with Shariah principles and follows a Fatwa issued by the Council of Senior Scholars in Saudi Arabia.

The initiative reflects Tabby’s commitment to providing transparent and Shariah-compliant Buy Now, Pay Later (BNPL) services. Tabby serves over 10 million users, helping them manage their spending and finances.

More than 30,000 brands and businesses, including SHEIN, Amazon, Adidas, IKEA, H&M, Samsung, and Noon, use Tabby to offer flexible payments online and in stores. Operating in Saudi Arabia, the UAE, and Kuwait, Tabby is valued at $1.5 billion, backed by investors such as Wellington Management, STV, Mubadala Investment Capital, and PayPal Ventures.