Karim Farra and Ziad Aboujeb are the founders of amana, a leading neobroker in the Middle East. The company’s flagship investing application provides convenience, ease of use, and security in accessing local and global financial markets. It is unintimidating and unassuming, making it hassle-free for both first-time and active traders. During the last 18 months, amana’s app has been downloaded 500,000 times, validating the product-market fit and customer appetite for the offering.

Breaking down barriers in the MENA region

There is no doubt that the Middle East is experiencing a generational evolution when it comes to investing in financial markets. Self-funded, Farra and Aboujeb thought to provide seamless and easy access to regionally listed companies in a space where market fragmentation in the MENA region has always been a challenge for the retail investor. As a result of these challenges, it often becomes burdensome for novice MENA investors to be exposed to trading opportunities beyond their borders.

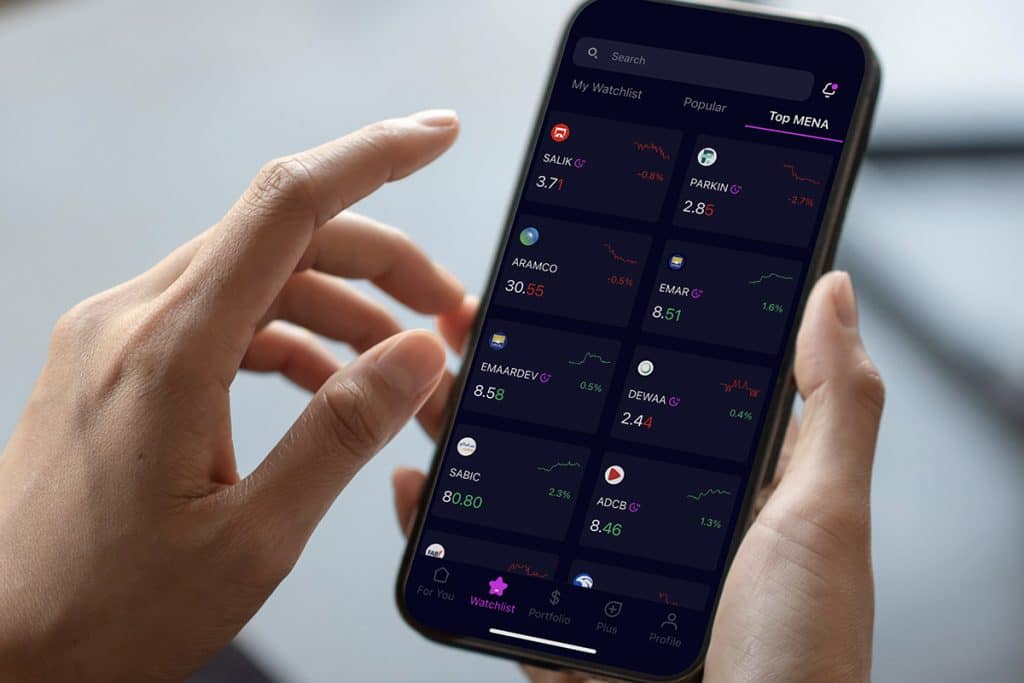

However, with the launch of their state-of-the-art investing and trading app, Farra and Aboujeb wish to ensure that anyone in the Middle East can buy shares in MENA stock markets, reflecting the region’s thriving economic development while also having an equal opportunity to participate in the global financial markets.

“Two years ago, we decided to disrupt the industry in the Middle East, and we’ve moved beyond the frames of a traditional brokerage,” Farra and Aboujeb state. “We created our own flagship trading app based on a highly personalized technology. It truly makes investing and trading as easy as ordering food online. That said, investing money is a serious endeavor, and so is amana’s role in emphasizing financial literacy to its user base.”

The founders and their backgrounds

Both Karim Farra and Ziad Aboujeb have experienced dynamic financial markets.

Farra was born into a global, multi-family business and grew up in finance. In particular, the 1987 stock market crash, Black Monday, marked his preteen years. As he entered college, he was fascinated by Warren Buffet’s storytelling lessons. He pursued an MBA at Wharton Business School, further exposing him to thought leaders who performed cutting-edge research in finance and capital markets.

Born a curious mind, Aboujeb, since his youth, has always been on the lookout for pain points in an attempt to solve them. Over time, his problem-solving abilities led him to become a serial entrepreneur, where he fused technology, knowledge, and common sense to build differentiated businesses in e-commerce and fintech over the last 20 years.

Karim Farra and Ziad Aboujeb founded amana with the goal of addressing the lack of connectivity between the 175 million people in the Middle East and the financial markets to help provide access and opportunity for everyone to build their financial future.

Using cutting-edge technology

Farra and Aboujeb believe that innovation and customization are the keys to success. As a result, they leverage cutting-edge technology to create what they describe as “a seamless and secure investment experience,” in which one can trade and invest in stocks, ETFs, currencies, commodities, cryptocurrencies, and more.

However, even with this said, amana is more than just an investment and trading platform. Though their application aims to unlock the MENA region’s potential in investment opportunities, they also provide MENA stocks alongside US shares, gold, oil, indices, and crypto, to name just a few assets. Their onboarding process takes only minutes and ensures users can start investing quickly and effortlessly.

A commitment to regional development

amana was born out of the opportunity to reshape the MENA region’s financial investment landscape, as well as cater to a market that has been underserved. In the ever-evolving financial landscape, Farra and Aboujeb believe it’s important, and even crucial, to look beyond traditional investment paradigms and to embrace opportunities in their locale. The MENA region, which has many dynamic markets and iconic companies, offers exciting avenues for investors to explore.

By introducing a newfound pricing strategy for MENA stocks, which used to be expensive and limited, MENA stocks can now be accessed by customers who can buy them at zero cost, with no exchange, clearing fees, or even commissions. This initiative alone caused the number of customers trading MENA stocks with amana to rise by about 70% in the first month alone!

Likened as the “Robinhood of the Middle East,” the amana app prioritizes accessibility, ease of use, and comprehensive education for all traders and investors.

“Our journey began with a focus on traditional brokerage services, but we quickly recognized the need for a more inclusive and user-friendly approach,” Farra and Aboujeb write. “Today, amana offers a platform that grants easy access to global and regional markets at the touch of a button.”

As amana continues to adapt and evolve, the company’s leadership is in the process of integrating AI tools into its business processes, making for a more compelling proposition to all stakeholders.

“We don’t take for granted our economic moat, and the journey of transformation is a continuous one,” the two write. “This is what we love and what makes us excited.”

Brand View allows our business partners to share content with Arabian Business readers.

The content is supplied by Arabian Business Brand View Partners.