Saudi Arabia’s real estate sector is on the cusp of a major surge, with the market predicted to see over 62 per jump over the next four-year period to hit close to $100 billion, offering high potential opportunities to both developers and investors, a latest research revealed.

Capital city Riyadh will be the epicenter of the surging property market growth in the country, projected to account for close to 50 percent of the market by 2027.

However, unlike the UAE which is making waves globally for its exponential growth in the residential real estate sector – both in terms of demand and price rises, the predicted growth in the Saudi market is to be led by the commercial segment which is estimated to grow a faster clip of 12 percent annually, compared to the 7-8 percent growth projected in the residential segment, the market research by RedSeer Strategy Consultants, a global consultancy, said.

“Major Saudi cities, especially the capital city, are witnessing significant office space development as major corporations establish their offices in the region, complying with government requirements to move regional headquarters into the country,” RedSeer said.

Jeddah and Dammam are the other two major cities in the country which are projected to see a spike in the property sector, projected to account for 25 percent and 9 percent, respectively, by 2027.

The country’s real estate market was estimated at $59 billion in 2022.

Stable real estate growth in Saudi Arabia

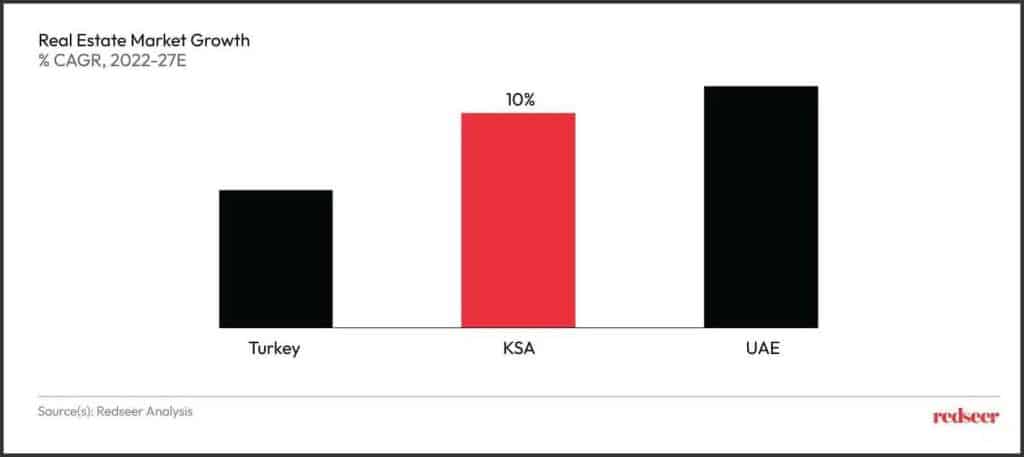

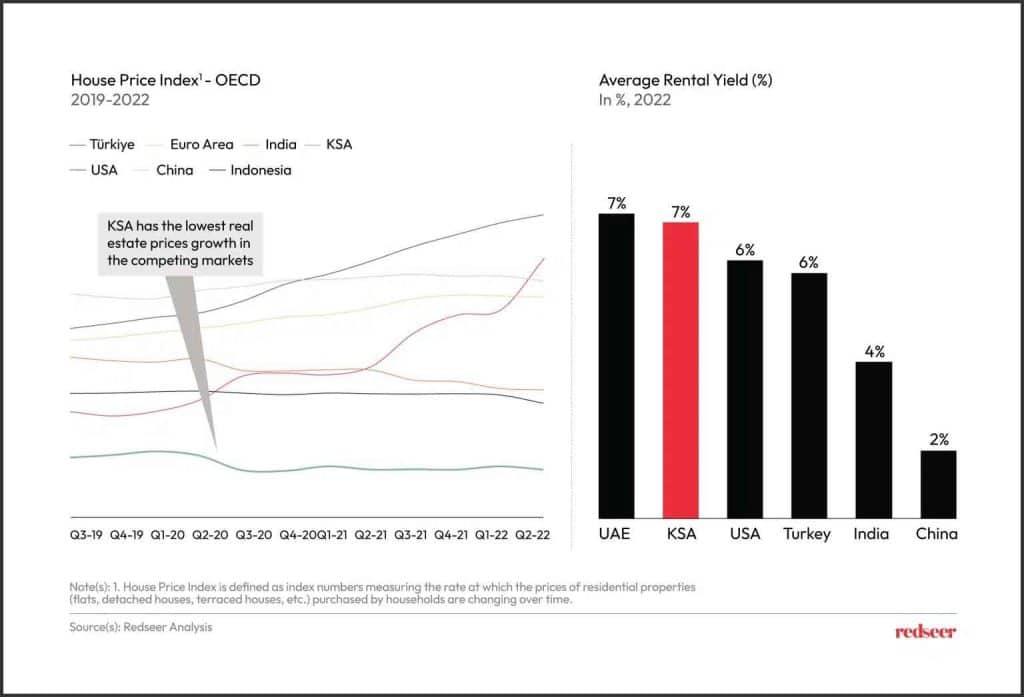

The study said the current supply-demand match in the Saudi market will see it growing consistently at 10 percent annually for the next four-year period without any major price flare up.

“Unlike their regional counterparts, Saudi Arabia’s real estate growth has not been driven by price increases due to limited supply. On the contrary, with supply matching the growing demand, [the country’s] real estate market has seen stable property prices,” Akshay Jayaprakasan, Associate Partner at RedSeer, told Arabian Business.

“While a lot of investments are being made right now, it will take a little longer for all the developments to see demand side adoption as well,” he said.

The study said the growth narrative in KSA is unfolding, and the real estate sector is directly benefiting from it.

This growth is driven by the government’s focus on real estate development, including major projects like NEOM and Diriyah Gate, with an aim to build more than 400,000 residential units by 2030 to drive homeownership up in the region, it said.

RedSeer, however, said the market dynamics could see some changes with the expected spike in international investments in the country’s real estate sector in the coming years.

Saudi Arabia has fully opened up the sector to foreign investments in August this year, with an announcement that foreigners will be able to purchase real estate of all kinds, including commercial, residential and agricultural properties.

“This move, once materializes, will attract foreign investments into the residential and commercial sector, driving more growth and potentially property price increases,” RedSeer said.

Top 5 players represent just 5-10% of the market

The study also revealed that despite the Saudi market’s attractiveness, the supply side remains fragmented, with the top 5 players accounting for only 5-10 percent of the market.

“This presents an excellent opportunity for leading and budding developers [from the region as also international players] to chart strong growth stories in the country,” RedSeer said.

Another factor which could attract buyers – including international investors – to the Saudi market is the prevailing high rental yields – estimated at over 7 percent – which is well comparable with that in Dubai.

“Despite the [relatively moderate] growth of the market, the rental yields remain high at about 7 percent, creating an attractive value proposition for investors as well as buyers,” RedSeer said.

New market players, however, will need to focus on brand building and creating strong awareness, developing marquee projects to solidify their right to win, it said.