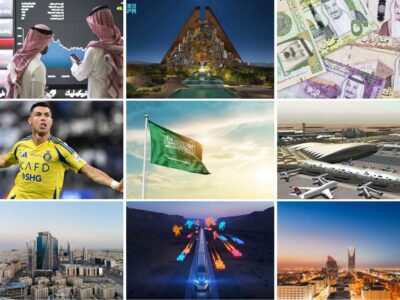

Borse Dubai, the state-controlled owner of Dubai’s two stock exchanges, is not planing to sell its stake in London Stock Exchange Group “in the near future” despite debt refinance concerns, its chairman said on Tuesday.Borse Dubai’s 20.6 percent holding in the LSE is “very strategic” and “we will keep our stakes” even as the Bourse is negotiating to refinance$4.2 billion of debt, Chairman Essa Kazim told a news conference in Dubai on Tuesday.

Borse Dubai’s new debt may pay interest equivalent to 6 percentage points over the London interbank offered rate on loans for three years, compared with a margin of 1.1 percentage points on existing loans, three bankers with knowledge of the transaction said on Nov. 12, newswire Bloomberg said.

Borse Dubai raised the money last year to pay for Swedish exchange operator OMX AB.

“We are still negotiating with the major banks that were initially involved to refinance the debt, plus we are also negotiating with new banksand we are very confident that we are going to get it,” Kazim told the conference.

The older loans do not mature until the end of February, Bloomberg reported him as saying.