In the ever-evolving landscape of global finance, two powerful forces have reshaped how we interact with money and revolutionised the accessibility of financial services: fintech and artificial intelligence (AI). This dynamic intersection uncovered the transformative potential globally, particularly in the Middle East.

According to a study by McKinsey & Company, the revenue of the fintech industry in the Middle East, North Africa and Pakistan (MENAP) is set to surge to between $3.5 billion and $4.5 billion by 2025, highlighting the region’s immense growth prospects.

Undeniably, these technological advancements have been accelerated by major macro events like the global financial crisis of 2008 and the COVID-19 pandemic, further disrupting traditional barriers in the financial ecosystem.

As a MENA-born company, we take immense pride in the innovation taking place in and from the region. Astra Tech has been at the forefront of this drive with our ultra-app ‘Botim’, which stands as the first and only platform facilitating open seamless connectivity, economic growth and financial inclusion. With over 140 million users and rapid global growth, Botim offers users, merchants and SMEs 3x faster UX, powered by the latest in fintech and AI software.

Navigating digital sovereignty

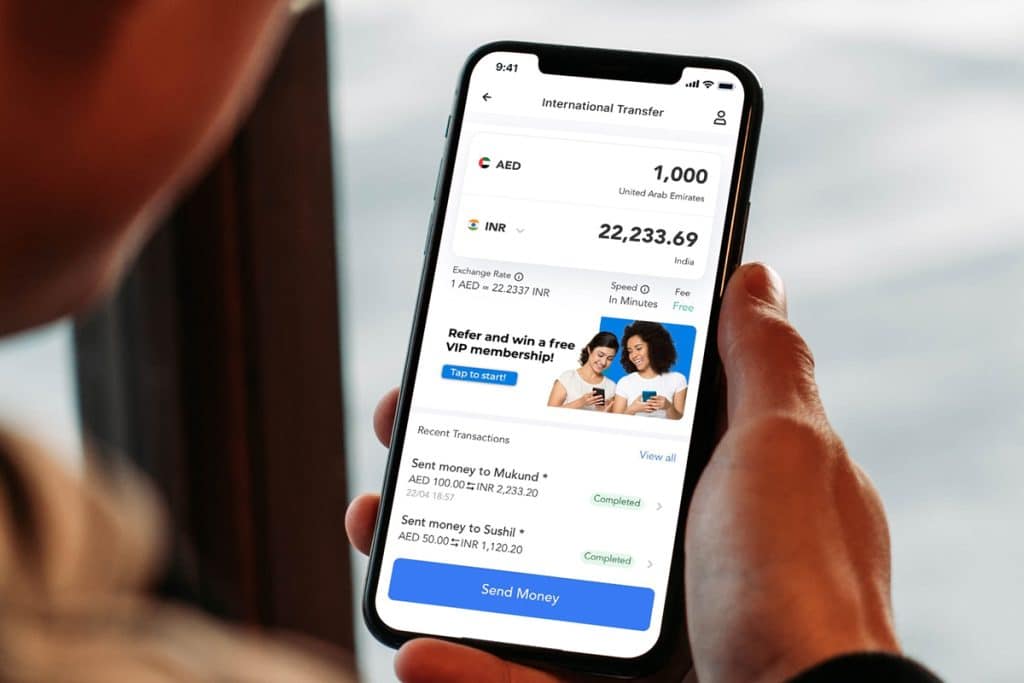

Astra Tech is committed to making financial services accessible to everyone – regardless of background or demographics – with the ultimate goal of simplifying people’s lives. Through constant innovation and market adaptability, we provide enhanced convenience and a wider range of services to Botim platform users. Our strategic acquisitions and partnerships approach has also propelled us closer to our vision of bringing innovative financial services to a broader audience, which are vital in navigating the fintech landscape.

In 2022, we acquired PayBy, a leading fintech company in the UAE which received licensing from the Central Bank of the UAE, enabling advanced payment technologies on the Botim platform for UAE users. This is in addition to our partnership with Mastercard to introduce prepaid cards to Botim users, providing them with the full spectrum of financial services.

Expanding into international markets, we recently acquired a majority stake in Y Finance, a licensed financing company in the Philippines, followed by a partnership with Banco de Oro, the largest bank in the Philippines, to facilitate secure cross-border transactions for Filipino expats in the UAE. Additionally, our collaboration with Fawry, Egypt’s top digital payments platform, enables seamless bill payments, invoices, and international money transfers between Botim users in the GCC and Egypt.

These partnerships exemplify our commitment to providing unrestricted access to financial services, driving digital transformation and most importantly, supporting underbanked communities.

The rise of AI in fintech

By fully embracing AI, we aim to revolutionise business operations and user interactions through Astra Tech’s Botim app, however, AI’s impact goes well beyond app features.

For instance, our recent launch of ‘B Store’ in the UAE is the world’s first fully autonomous shopping store with face pay. Using advanced AI and fintech solutions to streamline the entire process, customers can make payments through facial recognition. The future is here and now.

More so, AI’s predictive capabilities enable us to analyse vast data, extract valuable insights, and execute with precision. In the realm of financial services, AI plays a pivotal role in detecting and preventing financial fraud -a critical concern in today’s data-driven era. Real-time analysis of transaction patterns swiftly identifies and mitigates suspicious activities, hence minimising risks.

I believe that the subject of AI in relation to various sectors, particularly to fintech, will continue to dominate public discussions for the foreseeable future. The remarkable potential of AI lies not only in providing accessibility to a broad audience; it also enables the provision of advanced financial services to traditionally underserved and untapped markets. As technology continues to emerge and evolve, I look forward to being part of the future where AI plays a pivotal role in shaping the financial landscape – for everyone.

Brand View allows our business partners to share content with Arabian Business readers.

The content is supplied by Arabian Business Brand View Partners.