Dubai International Financial Centre (DIFC) and Standard Chartered signed a memorandum of understanding (MoU) to collaborate on digital assets, including digital asset custody.

Standard Chartered will launch digital asset custody services in DIFC, subject to regulatory approval, to cater to institutional clients globally.

The new services will provide custody of digital assets including cryptocurrencies and be powered by its subsidiary Zodia Custody.

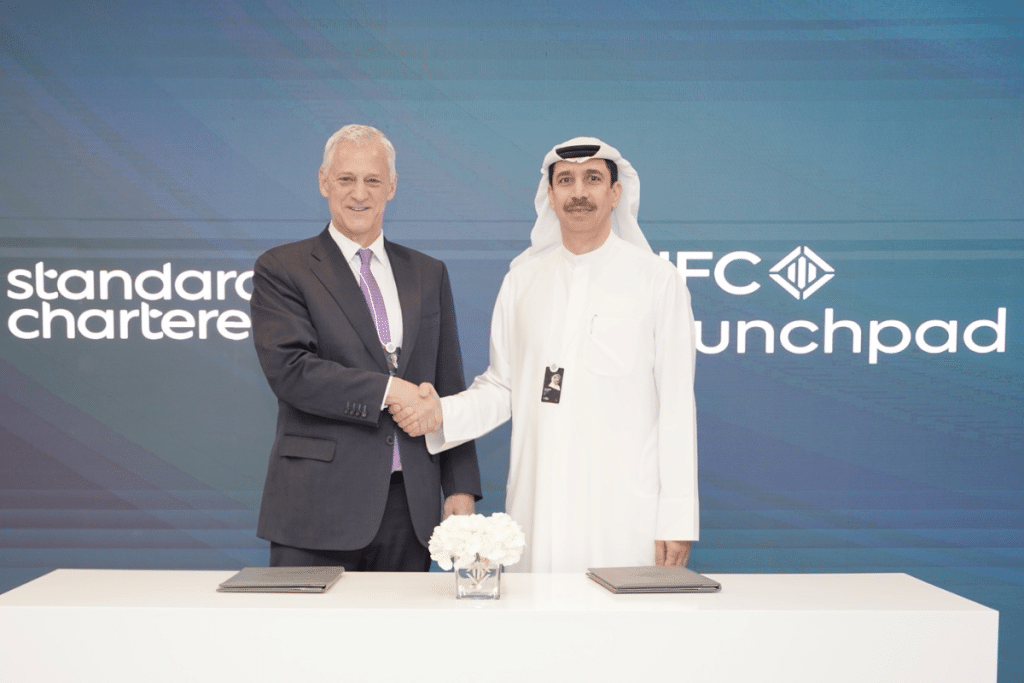

The agreement was signed at the Dubai FinTech Summit by Essa Kazim, Governor of DIFC and Bill Winters, Group CEO, Standard Chartered.

Winters said, “We see digital assets as an important part of the future of financial services and we are committed to investing in the infrastructure and talent necessary to be a leader in this space. The UAE has a well-balanced approach to digital asset adoption and financial regulation, making it an ideal first market for us to launch our digital asset custody proposition.”

Both parties will collaborate on the promotion of the digital assets ecosystem to benefit Dubai and the UAE economy.

Kazim said, “The Dubai FinTech sector has emerged as a key driver of innovation and economic growth much in line with the Government’s Dubai Economic Agenda (D33) to become a top 4 global financial hub. DIFC welcome collaboration with partners such as Standard Chartered to further accelerate growth, enable collaboration that triggers new innovation, as we continue to shape the future of finance together.”

In 2006, Standard Chartered became the first bank within the DIFC to purchase its own premises.