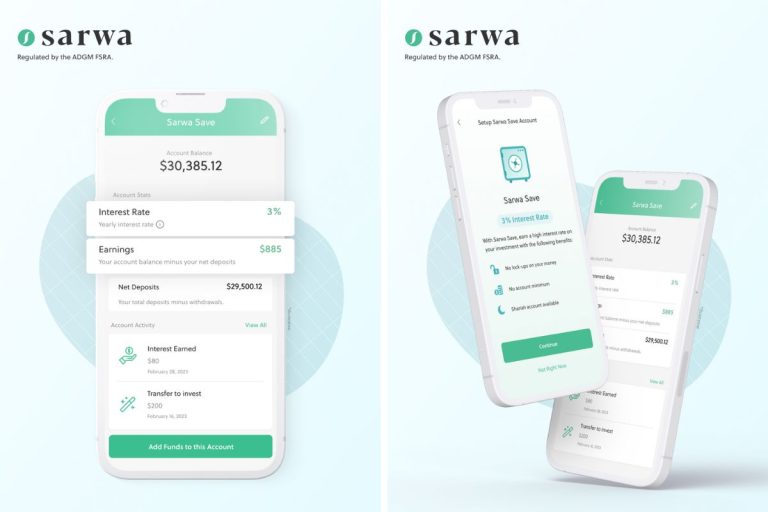

The UAE’s Sarwa has launched a new account with a 3 per cent interest rate for savers in the UAE.

The investment platform has more than 100,000 registered users and brings the new product to market as it looks to expand in the developing fintech sector.

The high-yield account is designed for investors seeking ease-of-access with a short-term appeal said the finance firm.

Sarwa Save features

- 3% interest rate

- Zero transfer cost for AED local accounts

- No account minimums

- No management fees

Mark Chahwan, Co-founder and CEO of Sarwa, said: “While we are strong believers in long term passive investing, we are also conscious of how market conditions might affect short and medium-term goals.

“Having a short-term investing option is an important part of a good financial plan. Our clients were asking for a product to park their cash while earning returns, with the same easy access and simple experience as their Invest, Trade and Crypto accounts.

“We listened to our community and decided to launch our fourth pillar: Sarwa Save”.

The fintech specialist offers users looking for a sharia compliant equivalent, a portfolio, which consists of cash and cash-equivalent securities projecting a return of 3%, net of all fees.

Recent studies showed that 43% of affluent individuals in the UAE said the Covid-19 pandemic weakened their confidence in their finances, preventing them from achieving their financial goals.

For those not investing, 35% of the total surveyed said general financial market volatility as the cause of their lower confidence, 30% said the fear of poor returns, while 26% said it was the complexity of developing an investment strategy.

Mark Chawan added: “The average yield on saving accounts in the UAE banks is around 0.8% as it stands today.

“Sarwa Save offers almost four times this amount. Diversification is at the essence of a sound investment strategy, and we’re happy to continue expanding our range of wealth management products”.