Tabby and Majid Al Futtaim will collaborate to spread buy-now-pay-later (BNPL) services across the GCC.

Majid Al Futtaim, the pioneer in shopping malls, communities, retail, and leisure across the Middle East, announced a strategic partnership with Tabby, the leading shopping and payments app in the GCC.

Initially the partnership allowed Tabby to operate within all Majid Al Futtaim-owned stores in the UAE malls.

Tabby and Majid Al Futtaim buy-now-pay-later

Tabby has now been built into the SHARE app, making Majid Al Futtaim the largest vendor utilising BNPL services in the region.

By integrating Tabby’s BNPL services into the Majid Al Futtaim SHARE app through the SHAREPay feature, the shopping experience is now newly revamped for home and luxury enthusiasts.

With this integration, customers can now shop at any Majid Al Futtaim mall, while enjoying the financial flexibility that BNPL offers.

Data shows that Home and Luxury are the most significant target markets for SHAREPay, highlighting the immense potential for shoppers in these categories.

SHAREPay is Majid Al Futtaim’s own digital wallet linked to its SHARE loyalty programme, allowing users to accumulate and spend points seamlessly across various Majid Al Futtaim brands and partners.

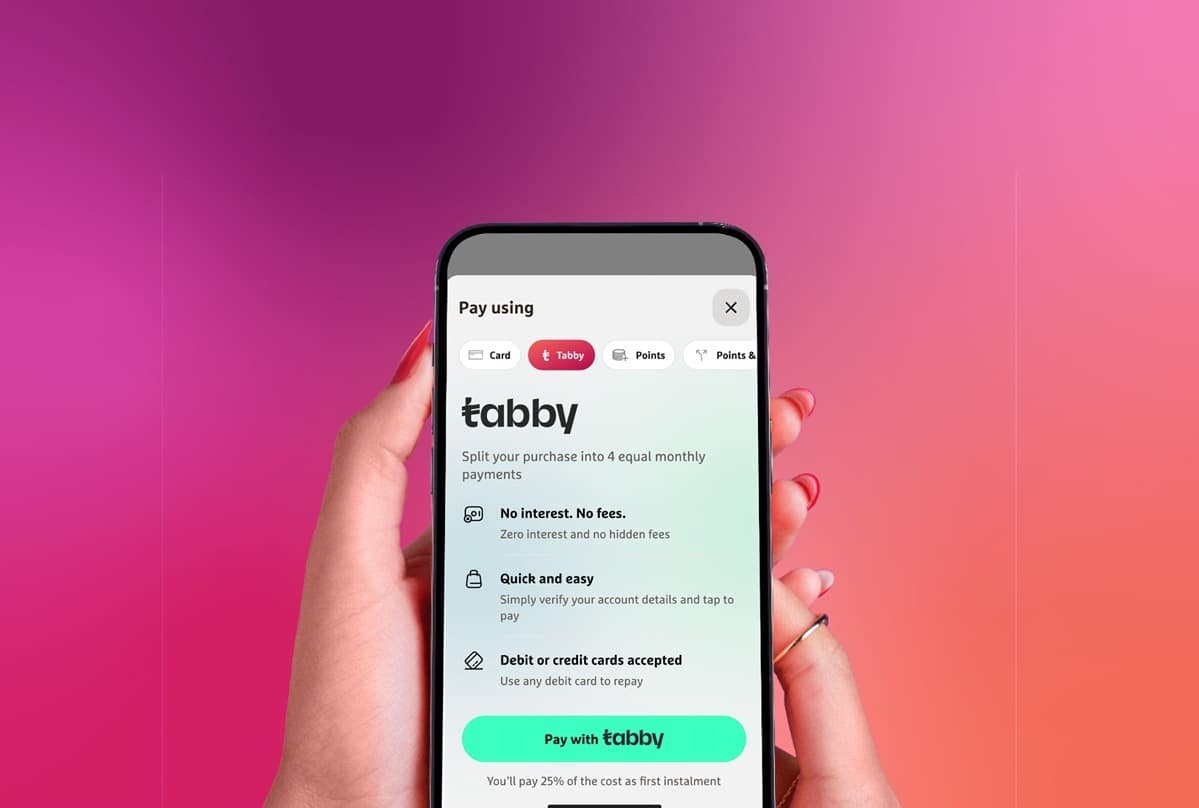

By incorporating the finance specialist into SHAREPay, Majid Al Futtaim is enhancing its shopping ecosystem and offering more flexible payment options to its customers, including the option to “Split in 4 – In any store”.

With this, shoppers can split purchases in four interest-free payments with no interest or hidden fees of any kind.

In the first nine months of the Tabby partnership, Majid Al Futtaim processed approximately AED253m ($69m) in BNPL transactions, surpassing the initial Year 1 budget of AED100m ($27.2m).

This significant increase highlights the strong demand and preference for flexible payment options such as Split in 4 among customers.

Over 216,000 total orders were placed across Majid Al Futtaim brands both online and in-store, with 14 per cent of customers ordering from more than one Majid Al Futtaim brand.

Additionally, 25 per cent of customers made multiple purchases when using Tabby through Majid Al Futtaim brands.

Notably, 60 per cent of Tabby shoppers purchasing from MAF brands are women.

Khalifa Bin Braik, CEO of Majid Al Futtaim Asset Management, said: “Our collaboration with Tabby is a pivotal juncture for Majid Al Futtaim, as it continues to significantly enhance the customer shopping experience across our malls.

“By integrating Tabby’s BNPL services into our SHARE app, we are providing our customers with greater financial flexibility and convenience.

“This partnership underscores our commitment to innovation and excellence, ensuring that we constantly meet the evolving needs of our customers”.

Hosam Arab, CEO and Co-founder of Tabby, said: “We’re proud of our partnership with Majid Al Futtaim and the flexibility we’ve brought to their shoppers.

“Now we’re taking it a step further with a one-of-a-kind integration with SHAREPay. This provides their shoppers with additional payment choices, and offers the ease, convenience and security of SHAREPay .”