Love at first sight is a real thing. Nothing makes a better impression than the first one, and that’s why airports are important. A well-managed and efficient airport is the best way to showcase the city – and the country – to the world.

Home to some of the finest airlines in the world, the Middle East is now planning to dominate the list of the world’s best airports as well.

In the 2024 World Airport Awards by SkyTrax, Hamad International in Doha moved one place above Singapore’s Changi to bag the top spot, while Dubai International made a massive jump of 10 spots to move to seventh place.

Dubai International, the busiest airport in the world in 2023, was voted second-best for 70+ million passenger airports, checking in after Tokyo Haneda. Hamad International was the best in the world for 40-50 million passengers. Bahrain and Muscat were Nos. 2 and 3, handling between 5 and 10 million passengers. Abu Dhabi and Amman were ranked fifth and sixth in the World’s Most Improved Airports list.

This wasn’t always the case. Even until the mid-1990s, most airlines viewed the Middle East airports as nothing more than technical stops.

What started with Dubai’s ambitions to become the world’s largest travel hub with the launch of Emirates Airline in 1985, has now spread across the Middle East. Countries want to take advantage of their strategic location and capture a bigger share of the long-haul market.

A recent OAG report on the Middle East aviation industry said: “The transformation can only be described as incredible, visionary in thought, near perfect in delivery, and resulting in the region becoming the centre of the aviation industry, linking nearly every major city in the world to at least one of the region’s major hubs. Four decades ago, many would not have believed the dream was possible. Today, that dream is reality, surpassing even the most optimistic expectations.”

The UAE and Qatar have led the aviation revolution in the region so far, but there is a new giant on the verge of joining, and possibly disrupting, the entire industry with its grand plans – Saudi Arabia.

As part of its Vision 2030, the Kingdom aims to attract 300 million air passengers by 2030 – almost three times the current estimated 107 million.

The UAE has its own ‘Tourism Strategy 2031’. Without specifying the number of tourists expected, the goal is to attract AED100 billion ($27.23 billion) in additional tourism investments and increase the number of hotel guests to 40 million. The strategy aims to raise the tourism sector’s contribution to the GDP to AED450 billion ($122.5 billion).

A key to executing such grand plans is for the country’s airlines is to have the capacity to handle the extra load. As of the end of 2023, the 10 largest airlines in the Middle East have placed a combined order of 795 aircraft to be delivered by the end of 2029—the largest order book in the world on a regional market basis.

A very natural corollary to this is the simultaneous upgrading of airports and increasing their capacities.

Here are some of the biggest airport infrastructure projects that are in the pipeline, or being executed right now…

Al Maktoum International Airport

Dubai, UAE

Dubai is investing AED128 billion ($34.85 billion) in expanding the Al Maktoum International Airport, the emirate’s second airport. When complete, it will handle up to 260 million passengers annually — the largest capacity in the world.

In 2023, Dubai International Airport welcomed 86.9 million passengers.

The expanded Al Maktoum airport will feature 400 gates and five parallel runways. Once complete, it will be five times the size of Dubai International, and all operations will shift to the new airport eventually. It will cover 70 square kilometres in Dubai World Central area, and handle 12 million tonnes of cargo per annum once fully developed.

The first phase, which can accommodate 150 million passengers annually, will be completed within the next 10 years.

The second phase of the airport’s expansion, which was launched in 2010 and the current terminal inaugurated in 2013, will be divided into two sub-phases. The first sub-phase involves the construction of new terminal facilities, concourses, and satellite terminals, as well as the expansion of existing facilities. The second sub-phase will involve expanding and constructing more runways, site grading, roads and tunnels.

Two parallel, 4.5km-long Code F runways – the largest runways with sufficient distance between them to enable simultaneous operations – are being built as part of the first sub-phase. They will have CAT IIIB landing system.

A new 165,000 square metre terminal will be constructed at the west end of the airport, offering a capacity of 35 million passengers per year. Two satellite concourses, each with an area of 385,000 square metre and an annual capacity of 65 million passengers, will also be constructed. The airport’s four concourses will form a megastructure, covering a built-up area of 2.3 million square metre.

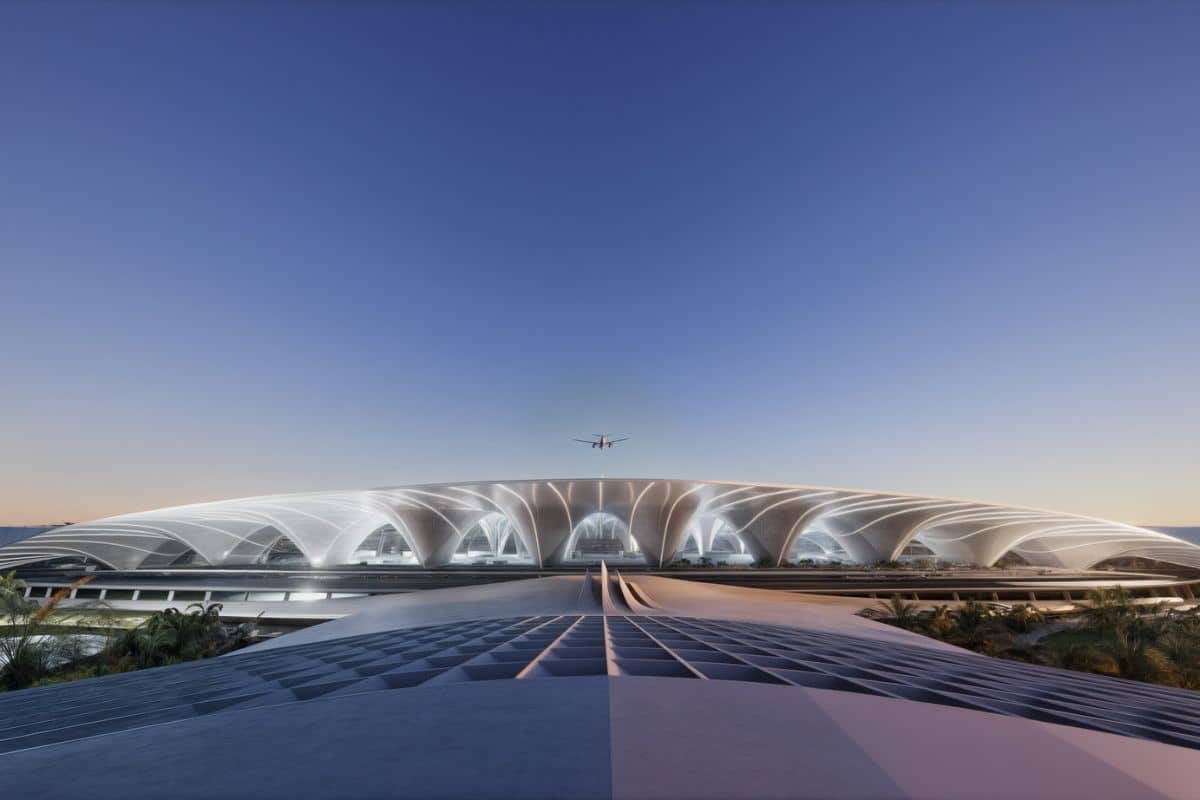

King Salman International Airport

Riyadh, Saudi Arabia

Announced in November 2022, Riyadh’s King Salman International Airport will be one of the largest in the world, covering an approximate 57 square kilometre area.

The airport will have six parallel runways and multiple terminals, including the existing terminals named after King Khalid. A 12 square kilometer area has been allocated for airport support facilities, residential and recreational facilities, retail outlets, and other logistics real estate.

Designed by Foster + Partners, the airport aims to accommodate up to 120 million travellers by 2030. It targets to handle 185 million travellers by 2050 and process 3.5 million tons of cargo.

The designers plan the airport to “become a dynamic aerotropolis centred around a seamless customer journey, world-class efficient operations, and innovation. Riyadh’s identity and the Saudi culture will be taken into consideration in the airport’s design to ensure a unique travel experience for visitors”.

Red Sea International Airport

Red Sea Project, Saudi Arabia

Inspired by the colours and textures of the desert landscape, the Red Sea International Airport is another Foster + Partners design and is set to become operational by the end of 2025. The airport is expected to reach a capacity of one million passengers travelling to the Red Sea Project tourism development by 2030.

The airport, which will be powered 100 per cent by renewable energy, will consist of five dune-like pods arranged radially around a central drop-off and pick-up space. Each pod will act as a mini terminal containing a departure lounge. The spaces between the pods will be filled with greenery.

Two wings will extend from either side of the main terminal and will house the airport’s ancillary spaces, including hangers, logistics bags, and baggage handling facilities. It will also have a dedicated seaplane runway and three helipads.

Abha International Airport

Aseer region, Saudi Arabia

Abha International Airport, the fifth-largest airport in Saudi by passenger traffic, is undergoing a massive expansion plan that is expected to be completed by 2028.

The first phase includes developing a new terminal that would increase the capacity almost nine times to 13 million passengers annually from the current 1.5 million.

India’s GMR Airports Limited, Turkish Mada TAV consortium, Incheon International Airport and Dar Al Handasah Consultants are some of the international organisations that have bid to undertake the terminal development under a public-private partnership. The selected company will be responsible for the airport development and operation for 30 years.

The expansion will increase the terminal space from its existing 10,500 square metre to 69,400 square metre in the first phase and to 73,200 square metre in the second phase. The new terminal will feature 20 gates.

The design of the new terminal will reflect Aseer area’s architectural heritage and draws inspiration from the Rijal Almaa village, a UNESCO World Heritage Site.

AlUla International Airport

AlUla, Saudi Arabia

Announced in October last year, the expansion of the AlUla International Airport comes within three years of two previous phases of development, which increased its passenger handling capacity in July 2020 from 100,000 to 400,000 a year.

A new airport terminal will increase the annual passenger capacity from 400,000 to six million. From 2035 onwards, Saudi Arabia expects more than 2 million visitors annually to AlUla, one of the most renowned archaeological and cultural sites in the Kingdom.

The new terminal’s design will include a five-star hotel apart from F&B and retail spaces.

Prince Mohammed bin Abdulaziz International Airport

Madinah, Saudi Arabia

The General Authority for Statistics in Saudi Arabia announced that the total number of external pilgrims performing Umrah in Madinah reached 8.37 million in 2022.

With these numbers in mind, Prince Mohammed bin Abdulaziz International Airport is being expanded to handle 17 million passengers a year by 2028. The design for the upgraded airport has been approved and work will commence this year. Turkiye-based TAV Airports, together with its consortium partner, will invest a total of $275 million in the project.

The existing Terminal 1 building will handle international traffic, and a new 39,000-square-metre terminal is being created for domestic passengers. A renovated terminal will be dedicated to Hajj and Umrah charter flights. The domestic terminal will be built over three levels, and will feature distinctive palm-tree-shaped steel columns.

NEOM International Airport

NEOM, Saudi Arabia

The future city already has an airport – NEOM Bay – but plans to build another mega, sustainable airport very soon. Not many details have been made public, but the US-based infrastructure consulting firm AECOM has been tasked with providing project management consultancy services for the proposed international airport.

Al Jouf International Airport

Sakakah, Saudi Arabia

The Al Jouf Airport project includes 14 aircraft parking bays and a new 47,000-square-metre terminal, increasing the airport’s total capacity to one million passengers annually.

Work is expected to begin in September, and construction will last two years. Following the expansion, the airport will have seven travel gates and four bridges and can handle two international flights and five domestic flights simultaneously.

Hamad International Airport

Doha, Qatar

Hamad International Airport launched the first phase of its expansion plan in 2022 to accommodate the inflow of traffic during the FIFA World Cup. It is now in Phase B of its development, which will increase its capacity to 70 million passengers annually from the current 58 million.

Phase B expansion will include a new 95,000-square-metre concourse, extensions of Concourse D and E, and the construction of a new cargo terminal on a 323,000-square-metre plot next to the existing Cargo Terminal. The new cargo terminal, which will be an 85,000 square metre multi-level building, will increase handling capacity to 3.2 million tonnes per year.

Construction of Phase B commenced in January last year.

The much-acclaimed Phase A increased the terminal space to 125,000 square metre, and features a new 10,000 square metre indoor tropical garden called Orchard in the new central concourse.

Kuwait International Airport

Kuwait City, Kuwait

An 18-month design phase, followed by a three-and-a-half year construction phase will give a significant facelift to Kuwait International Airport.

The upgrades include increasing the central runway and associated taxiways to 4,300 meters, thus adhering to Code 4F standards with a precision approach of CAT IIIB, expanding the cargo apron to 1.5 square kilometre to accommodate 77 aircraft stands, establishing a new VVIP Apron with dedicated aircraft stands and a run-up area for distinguished guests and enhancing existing facilities.

Terminal 2 (T2), which has been slightly delayed, is being developed to transform it into a state-of-the-art terminal at a cost of $4.3 billion. The first phase will add a capacity of 13 million passengers a year, while the subsequent phases enhance it to between 25 million and 50 million passengers annually.

Located in one of the hottest places on Earth, the new terminal’s design and construction use climate-responsive materials. It has a single roof canopy with glazed openings that filter daylight and deflect direct solar radiation.

Oman – six new airports by 2029

Just a few years after opening the new Muscat International Airport at a cost of $1.8 billion, Oman is planning to build six new airports across the country to boost tourism and logistics.

This will increase the number of airports in Oman to 13 by the end of 2029 as the country gears up to handle a projected 50 million tourists by 2040. Oman had 17 million tourists in 2023.

These new facilities, including one in the popular tourist city of Musandam, will help connect passengers with Oman’s industrial areas in Sohar, Salalah, and Duqm.