With the post-pandemic era approaching and investors targeting long-term financial stability and value creation, careful consideration must be exercised.

Although investors boast considerable liquidity, geopolitical, economic, and technological contexts have experienced post-outbreak differentiation, while private equity (PE), corporate mergers and acquisitions (M&A), and greenfield foreign direct investment (FDI) trends have been amplified. And as such, understanding the latest global investment flow dynamics is key for deploying capital wisely.

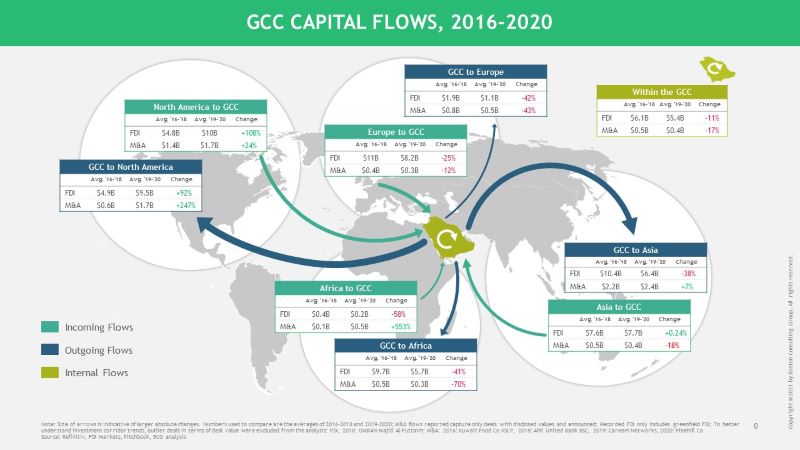

When assessing recent investment flow landscapes, the GCC was broadening its horizons even before the pandemic, looking further east and west for investment opportunities rather than within the Middle East and North Africa (MENA) – although the investment landscape has not been without challenges and change. For example, FDI investment from Africa decreased by 41 percent between 2016-2020, while European FDI investments were similarly down, with outbound and inbound investments decreasing 42 percent and 25 percent, respectively.

Yet opportunities were capitalised upon during the same period by investor community segments. M&A investments to and from North America increased by 247 percent and 24 percent, respectively, with outgoing FDI rising by 108 percent.

Additionally, positive growth was derived from dealings with Asia, despite overall investments being down, with incoming M&A recording a 7 percent increase and outgoing FDI rising by 0.24 percent.

However, Covid-19 has left many regional investors pondering their futures, especially with recent capital increases in particular areas transpiring at the expense of others.

Renewable energy and fossil fuels

Accelerated by the pandemic, environmental, social, and corporate governance factors have become more central to investment decision-making processes, with renewable energy accompanying chemicals as the sole sectors to witness growth following recent economic turbulence. The latter’s growth was primary attributed to industrial gas plant investments in Saudi Arabia and interest in green hydrogen as part of the NEOM project, with positive investment similarities becoming apparent in renewable energy.

Predominantly driven since 2019 by the United Arab Emirates’ (UAE) focus on renewable energy, incoming external greenfield investments have recorded a 187 percent increase from an annual average of $1.03 billion between 2016-2018 to $2.9bn between 2019-2020.

Moreover, the total incoming flow of external greenfield FDI investments from 2016-2020 reached $9bn. The UAE accounted for 83 percent of this flow with $7.47bn. Oman followed with 13.3 percent worth $1.2bn, with this flow primarily originating from Japan, Belgium, and Switzerland.

From an internal standpoint, greenfield renewable energy investments were another segment that witnessed sizeable growth, recording a 200 percent increase from $1bn between 2016-2018 to $3bn from 2019-2020. Saudi Arabia was the key driver of this trend, responsible for 80 percent worth $1.8bn.

A majority of these investments have been redirected to the UAE, with the remainder distributed to Bahrain, Oman, and Saudi Arabia.

Yet as alluded to previously, renewable energy is one of two sectors to have gained recent advantages, with the pandemic and changing demands instigating alarming declines from a greenfield FDI perspective.

Fossil fuel-related sectors, including coal, oil, and gas, have been affected by this occurrence, recording a 35.5 percent average yearly incoming greenfield investment decrease of $6.2bn between 2016-2018 to $3.9bn from 2019-2020.

At the same time, outgoing greenfield investments stagnated, decreasing by 55 percent to $1.6bn over one year beginning 2019.

A slow recovery for FDI is therefore expected in the years ahead, with a resurgence dependent on beneficial government actions such as parity for foreign firms, focusing on areas for economic growth, and relaxing trade and investment policies. That being said, renewable energy and fossil fuels are not the only sectors requiring understanding.

Private equity and real estate

As regional investors look ahead, the PE landscape also calls for examination. Global growth had already been slowing before the outbreak, due in part to geopolitical tensions and a nascent economic decoupling between nations and their regions, although there is cause for optimism.

At present, PE accounts for a minority of capital flows within the GCC – approximately $77bn out of $502bn total investments from 2016-2020. The UAE is responsible for most PE deals in the GCC, with 80 percent of inbound and outbound business originating from the country.

A 25 percent decrease in total PE deal volume transpired between 2016-2018 and 2019-2020, from 65 average annual deals to 49.

Crucially, though, PE firms have the means to halt investments in difficult operating climates and the flexibility to deploy capital and capitalise on attractively priced assets when opportunities appear. Therefore, it is feasible that regional PE investments rebound in due course.

The pandemic also impacted the real estate market and, although outgoing greenfield real estate investments remained resilient, those incomings have seen an average yearly decrease of 76.6 percent from $1.48bn between 2016-2018 to $347 million between 2019-2020.

With the partnership between Oman Tourism Development Company (OMRAN) and Majid Al Futtaim being an exception, internal investment levels dropped by 76 percent to $763m.

However, there are real estate positives to highlight, particularly where outgoing M&A is concerned, with investors pursuing the M&A route to consolidate their interests.

Average yearly investments increased by 170 percent from $1.13bn between 2016-2018 to $3bn by 2020, with growth primarily stemming from the UAE, comprising mainly large international firms purchasing properties via local subsidiaries.

Collectively, these insights will help guide the regional investment community forthwith, helping incumbents adapt to fundamental shifts.

For GCC investors, the post-pandemic operating landscape is becoming more apparent as new bounds converge with already present components. Pre-outbreak trends, including rising PE influence, investments regionalisation, and technology prioritisation, will continue to unfold and even accelerate.

Yet recent disruptions are simultaneously instigating radical consumer behavioral changes, creating scenarios in which some industry verticals are more lucrative than others. Therefore, increasingly prominent investment areas will significantly impact how global capital flows into various industries around the world.

Rami Rafih, managing director and partner, Boston Consulting Group; and Christian Oussi, principal at Boston Consulting Group