Al Hilal Bank has become the world’s first Islamic bank to use Blockchain technology for the resale and settlement of an Islamic Sukuk (Sharia-compliant bond). It was used to transact a secondary market deal in Al Hilal Bank’s $500m Senior Sukuk maturing in September 2023.

Al Hilal Bank’s CEO, Alex Coelho, said that the technology will improve the security of similar transactions, paving the way for further digitised “Smart” Islamic Sukuks: “The advantages of using smart contracts range from safer transactions with robust Shariah compliance, to the unlocking of new opportunities.”

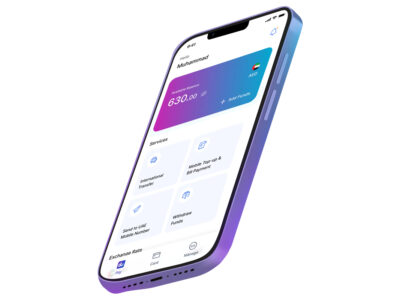

The initiative is the result of the collaboration of Al Hilal Bank Digital Transformation team with Jibrel Network, a UAE-based FinTech. The collaboration was made possible thanks to the support of Abu Dhabi Global Markets’ (ADGM) FinTech platforms that foster an interactive, collaborative and vibrant ecosystem for innovation to take root in Abu Dhabi and the region.

Islamic Sukuk have been one of the fastest growing asset classes in recent years with $97.9bn worth of Sukuks issued in 2017 – a 50 percent increase from 2016. Smart Sukuks could provide transactional efficiencies and significantly reduce the overheads associated with issuing and settling Islamic Sukuks.

ADGM CEO, Richard Teng commented: “As an international financial centre and FinTech thought leader, ADGM is proud to play an instrumental role in fostering an ecosystem for cutting-edge technology providers to collaborate with innovative local financial institutions in delivering value across financial markets.”

Jibrel Co-Founder, Talal Tabbaa, added: “We are firm believers that by combining Jibrel’s tried and tested smart contract solutions with the world class industry expertise held by Al Hilal Bank’s Digital Transformation Team, we will be able to provide Islamic financiers with the necessary tools to facilitate Islamic agreements with the same speed, volume and efficiency experienced in conventional finance, and potentially develop new digital asset classes that were previously unimaginable.”