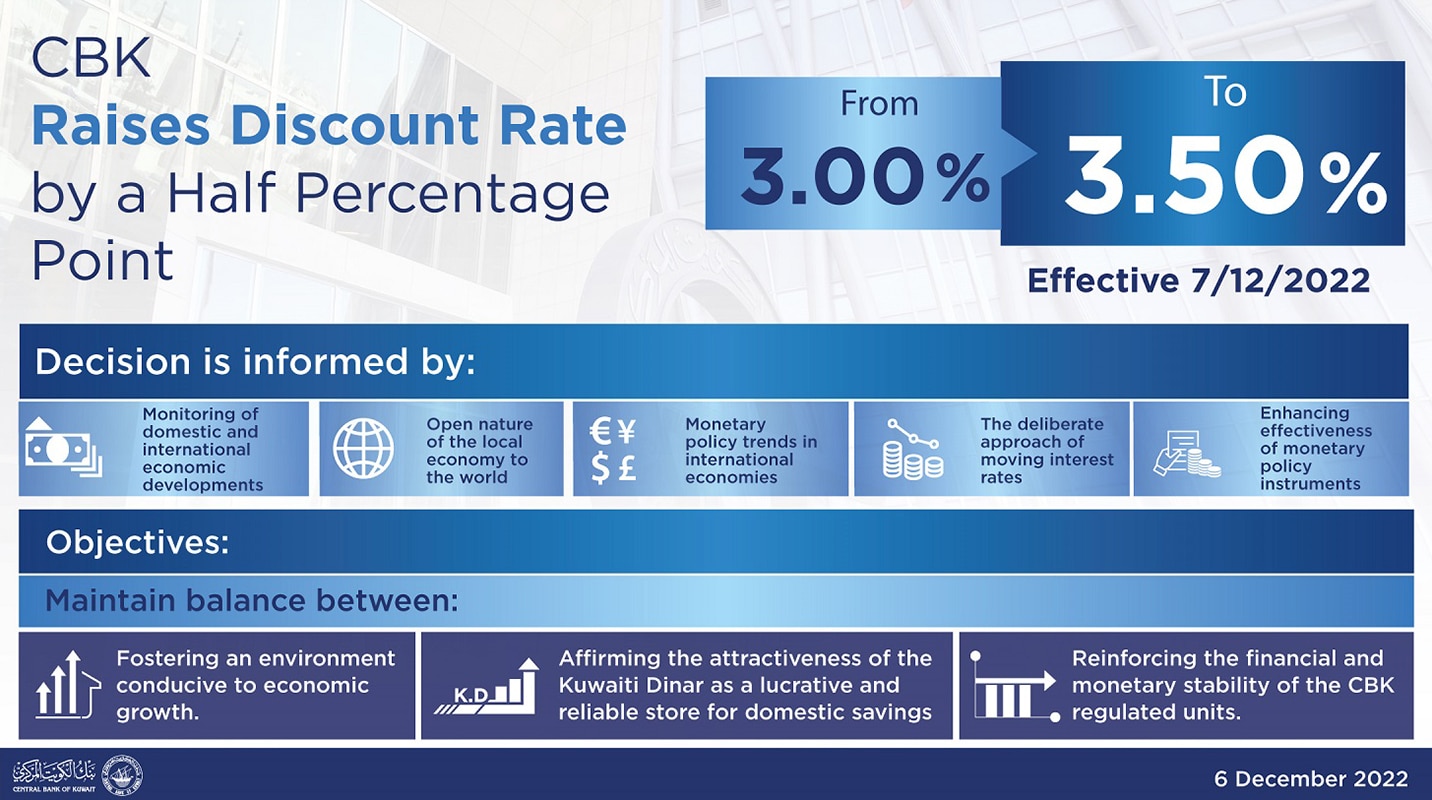

The Central Bank of Kuwait said it will increase its discount rate by 50 basis points to 3.5 percent as of Wednesday.

A high discount rate tends to lead to an increase in other interest rates, as it represents the cost of borrowing money for most major commercial banks and other depository institutions.

Kuwait central bank Governor Basel Al-Haroon said in a statement that the move is consistent with the bank’s goals of promoting a growth-friendly environment, upholding financial and monetary stability, and preserving the allure of the national currency as a store of wealth.

The Kuwaiti dinar is pegged against a basket of currencies that includes the dollar, which gives it more flexibility to stray from Fed policy than other Gulf Arab countries, which have their currencies tied to the dollar.

Meanwhile, the Indian central bank also announced a 35 basis points hike in lending rates to 6.25 percent on Wednesday.

Wednesday’s rate hike – the fifth consecutive by the Reserve Bank of India this year – however, was lower than the 50 basis points in the previous three rounds, signalling a climb down from the earlier hawkish stance on containing rising inflation.

The US Federal Reserve also recently indicated its plans for a less aggressive hike in lending rates in the coming rounds, as central banks around the world are making efforts to ward off looming recession as well, while containing inflation.