The rising interest rates are leading to a surge in rush for housing loan refinancing in the UAE’s mortgage market, triggering a ‘friendly fight’ between banks and mortgage platforms to woo customers with an array of combo offers on competitive rates and faster processing.

In the latest round of rate tightening, the UAE central bank announced a 25 basis points hike in lending rates last week, following a similar rate hike by the US Federal Reserve.

The hardening of interest rates is also encouraging buyers to take the leap to ownership by locking in better long-term rates before it’s too late.

“As expected, rising interest rates have had an impact on mortgages, especially for those customers who have had variable rates and short-term lending periods,” Fouad Chemlati, General Manager – Mortgages at Huspy, a leading proptech service venture in the UAE, told Arabian Business.

“And this is now leading to hordes of customers looking to refinance loans and find the best offers online,” he said.

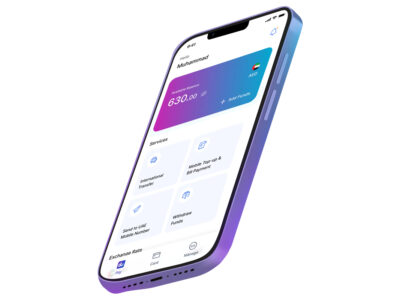

Chemlati also revealed that Huspy has launched a new broker portal to enable all its property broker partners to access the platform’s all mortgage products and also to submit mortgage cases, apparently in a move to give banks a good fight in cornering the business.

“Besides driving innovation in the sector, the new ‘Huspy Broker Portal’ will empower our broker partners with technology to access all our mortgage products, submit mortgage cases, create white labelled proposals for their clients, and track progress of the mortgage applications,” he said.

Senior executives at some of the banks and other players in the mortgage sector also confirmed the trend of the loan refinancing rush in the aftermath of consecutive rounds of rate hikes by the central bank of the UAE and around the world, besides anticipation of more such rounds to tame rising inflation.

Technology transforms mortgage business in the UAE

The Huspy senior executive said easy and affordable property financing making homes more accessible is also a major factor making Dubai and the larger UAE an attractive market for real estate investments, driving international investors to the market.

To add to it, technology is transforming the entire mortgage business and also the home-buying journey in Dubai and also pan UAE.

“Typically, home buyers have had to deal with multiple stakeholders on different platforms, diluting the home buying experience. With technology, we are changing this by bringing all stakeholders onto one platform, and giving buyers a single access to the best rates, fastest financing and an amazing end-to-end experience,” he said.

Chemlati said Huspy has processed over $3 billion worth of loans in the UAE till today, becoming the largest mortgage platform in the country.

“With our technology, processing is much faster than traditional methods, and 90 percent of our customers secure approvals because of our rigorous processes. We also place a priority on pre-approvals, as this helps customers to close on the home of their dreams faster,” he said.

Industry experts said access to financing remains one of the largest barriers to home ownership, with the process still remaining largely cumbersome.

A large majority of home buyers in Dubai – as also in other markets – are dependent on mortgages to own the home of their dreams.

UAE’s attractive property pricing lures investors

Chemlati said besides the affordable lending rates, the UAE still remains a very attractive market for international investors because of its great per-square-foot (sq. ft) pricing for residential properties.

He said according to market research, $1 million buys 105 sq. m-sized residential property in the UAE – five times as much space as in Hong Kong.

“This not only presents great value for money but delivers high ROI (return on investment) as well,” the Huspy senior executive said.

Chemlati said with an average mortgage size of AED1.8 million, the UAE real estate market is attracting buyers from every major demographic – young first-time owners, families, older investors, and also from around the world.

On average the UAE offers mortgages at approximately 4.7 percent for residents and about 5.14 percent for non-residents.

Chemlati said the entire real estate ecosystem in the UAE is well-governed, protecting buyers and sellers.

The high loan-to-value ratio for residents means customers need to only make a 20 percent down payment.

Besides, the UAE government also introduced schemes recently to make repayments easier for Emirati nationals.

“The current rush for mortgages and loan refinancing, coupled with our technological prowess, has helped us to emerge as the largest mortgage platform in the UAE, with thousands of offers from the leading financial institutions in the country,” Chemlati said, adding that the company has acquired three mortgage businesses last year to reach an even larger customer base.