The Abu Dhabi real estate market saw notable increases in sales prices and rental rates across both affordable and luxury segments in the first half of 2024, according to a new report by Bayut.

In the luxury villa segment, residential island communities have seen substantial price appreciation. Yas Island emerged as a standout performer, with prices for luxury houses increasing by 10.3 percent. This significant rise is attributed to the increased demand for upscale properties in the area.

Other luxury villa locations also experienced notable growth, with prices rising by up to 10 percent across popular areas.

“Over the past six months, we have seen the Abu Dhabi real estate market grow, stabilise and then grow again. Recent industry reports by the Abu Dhabi Real Estate Centre (ADREC) confirm that foreign direct investment is at an all-time high in the capital, cementing the emirate’s position as a strong contender among global property markets in the last 18-24 months,” Haider Ali Khan, CEO of Bayut and CEO of Dubizzle Group MENA said.

Luxury demand drives capital growth

The luxury apartment market has shown similar strength. Saadiyat Island recorded the highest appreciation at 6 percent, solidifying its position as a prime location for high-end flats.

Premium apartments in Yas Island and Al Reem Island also saw price increases of 2.77 percent and 2.75 percent, respectively, further demonstrating the robust demand for luxury properties in the capital.

In the affordable segment, the market has shown resilience and growth. Apartments in Al Ghadeer recorded a significant increase of 9.5 percent in advertised sales price-per-square-foot, while affordable flats in Al Reef witnessed a ‘modest rise’ of 2.16 percent.

This trend indicates a growing interest in more budget-friendly options among buyers and investors.

Notable price movements in villas

The villa market in the affordable segment has also seen positive movement. Average sales prices per square foot for budget-friendly villas increased by up to 7 percent in the first half of 2024.

Notably, villas in Al Ghadeer and Al Samha reported substantial hikes of 6.10 percent and 5.57 percent, respectively.

However, it’s worth noting that villas in Khalifa City bucked this trend, experiencing a slight price drop of 1.73 percent.

The report further highlighted several areas offering attractive returns on investment (ROI). In the affordable category, apartments in Al Ghadeer emerged as a lucrative option with a high projected ROI of 8.52 percent.

For those interested in the luxury segment, Al Reem Island maintained its popularity for apartment purchases, offering a strong projected rental yield of 6.94 percent during the first six months of 2024.

In the villa segment, Hydra Village stood out by offering the highest ROI of 8.08 percent for affordable houses.

For luxury villa investments, Yas Island properties demonstrated an impressive ROI of 6.89 percent, further cementing the island’s status as a prime location for high-end real estate.

Off-plan developments attract interest

The report also shed light on popular off-plan projects. In the affordable apartment category, Royal Park and Bloom Living emerged as the top choices for budget-conscious investors.

For luxury buyers, island community off-plan developments such as Yas Bay, City of Lights, and Saadiyat Cultural District attracted significant interest.

In the villa segment, Fay Al Reeman 2 was favoured by small-ticket investors for affordable options. For luxury off-plan villas, Yas Acres and Murjan Al Saadiyat remained popular choices among buyers.

Rental property market in Abu Dhabi

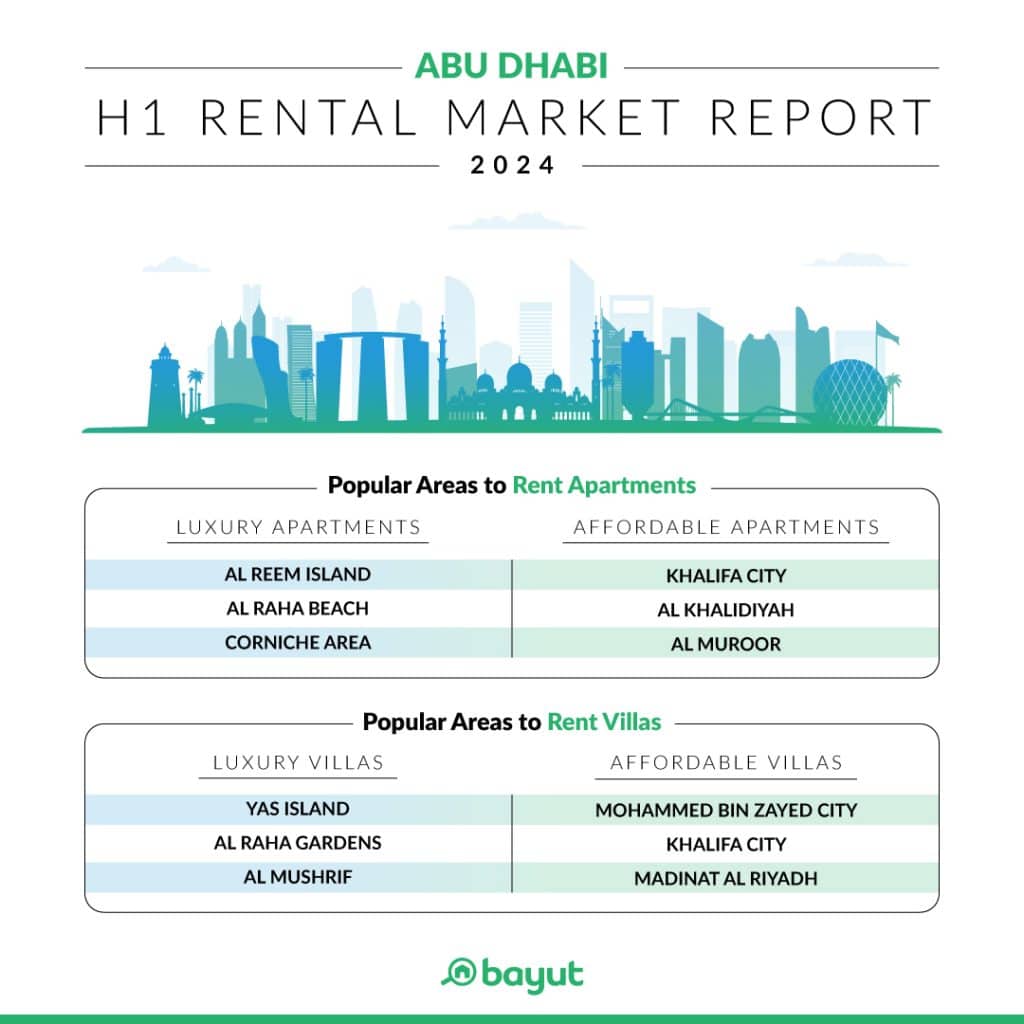

Bayut’s analysis also revealed a dynamic and resilient rental property market in Abu Dhabi. In the affordable segment, Khalifa City and Al Khalidiyah have been prominent choices for apartment rentals, while Mohammed Bin Zayed City (MBZ City) and Khalifa City emerged as the top searched areas for renting affordable villas.

For those seeking luxury rentals, Al Reem Island and Al Raha Beach were the preferred locations for apartments.

Yas Island and Al Raha Gardens led the rental market for high-end villas, reflecting the continued appeal of these areas to affluent tenants.

The luxury apartment rental market has shown remarkable growth, with prices increasing by up to 21 percent in popular areas such as Saadiyat Island and Al Raha Beach.

This substantial rise indicates strong demand for high-end rental properties in these desirable locations.

In the affordable segment, apartment rentals have also seen appreciation, with increases of more than 7 percent in areas such as Al Muroor. This trend suggests a growing demand for more budget-friendly rental options in the capital.

The villa rental market has shown varied trends. Affordable villa rentals have seen increases of almost 7 percent in most areas, although Shakhbout City was an exception, recording a minor decline.

“The diverse range of off-plan projects currently available in Abu Dhabi has significantly contributed to this heightened interest from international HNWIs and investors, particularly in the luxury segment. With the government proactively bringing in more regulation and transparency, we can expect the properties in the capital to continue drawing both local and international interest. Demand has also remained high on Bayut throughout 2024 with traffic increasing steadily month on month, and we can expect this trend to continue into the second half of the year as well,” Khan added.