Data from UAE-based InsuranceMarket.ae has revealed that average car insurance premiums declining by an average of 9.5 percent in 2019 year-to-date, compared to the same period in last year.

InsuranceMarket.ae released data also showed Nissan, Toyota, Ford, Honda and Mitsubishi as the top five insured car brands in the country.

Average premiums for Nissan cars fell from AED1,983 to AED1,780 in the past year, down 10 percent, while Toyota premiums fell 9 percent to AED1,858, Ford (down 9 percent) to AED1,972, Honda (down 10 percent to AED1,528) and Mitsubishi (down 7 percent to AED1,744).

The Mitsubishi Pajero took the top spot for the most popular car model insured in the first half of 2019, overtaking the Nissan Tiida, and reinforcing the popularity of SUVs in the UAE.

Three of the top five most popular car models insured so far this year are SUVs, with the Ford Edge and Ford Explorer being the fourth and fifth most popular models respectively.

Toyota Corolla and Honda Civic make up the rest of the top five, as Nissan Tiida, Honda Accord and Nissan Sentra drop in popularity, the report said.

“Our data highlights an overall decline of 9.5 percent in premiums on average for car owners in the UAE. These cost savings likely reflect a reduction in traffic accidents this year as well as increasing efficiency in insurance distribution. Last year’s regulation from the UAE Insurance Authority introducing no-claims bonuses has also had an impact, as safer drivers begin to be rewarded with discounts on premiums for policyholders with claims-free records,” said Avinash Babur, CEO of InsuranceMarket.ae.

Other factors contributing to the decrease in premiums include market depreciation as new car sales slowed, he added.

“As the process of purchasing used vehicles has become more accessible and convenient due to improved infrastructure, more people seem inclined to buy less expensive pre-owned cars, which in turn leads to lower insurance premiums,” said Babur.

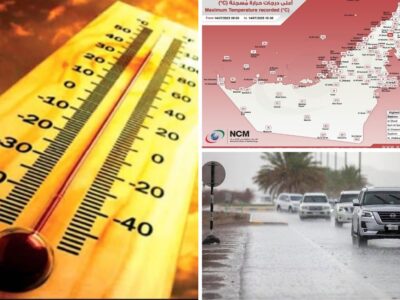

The study also revealed that the largest number of insurance claims are made over the summer months and during Ramadan.

Three quarters of InsuranceMarket.ae users opt for comprehensive insurance coverage rather than third party only insurance, the data revealed.