The UAE Ministry of Finance has issued a Ministerial Decision allowing taxpayers to claim tax depreciation on investment properties held at fair value under Federal Decree-Law No. (47) of 2022 on the Taxation of Corporations and Businesses.

Under the decision, taxpayers who elect for the realisation basis can now deduct depreciation from their taxable income for investment properties maintained on a fair value basis.

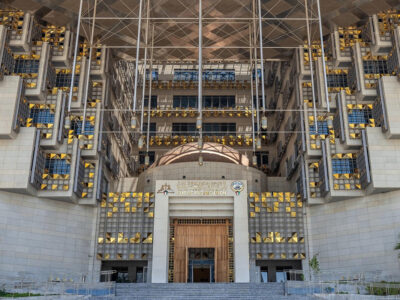

UAE updates tax depreciation for investors

The tax depreciation deduction will be calculated as the lower of the tax written down value of the investment property or 4 per cent of the original cost of the investment property for each 12-month tax period, with pro-rata adjustments for partial tax periods.

The deduction applies to taxpayers who hold investment properties both before and after the introduction of corporate tax.

The decision clarifies the value basis for tax depreciation claims depending on whether the investment property is transferred between related parties, third parties, or has been constructed by the taxpayer.

The ministry stated the decision creates parity between taxpayers holding investment properties on a historical cost basis, who can already benefit from accounting depreciation deductions, and those holding investment properties on a fair value basis.

To access this benefit, taxpayers must make an irrevocable election in their first Tax Period beginning on or after January 1, 2025 in which they hold an investment property. This election will apply to all investment properties going forward.

The decision includes an exceptional window for taxpayers to elect for the realisation basis to access the tax depreciation deduction, given that the realisation basis election is typically made in the first Tax Period.

The ministry has provided guidance on when claw-back of tax depreciation may occur in instances outside of disposal of an investment property.

This ensures taxpayers understand their tax compliance obligations and can assess their returns on investment property.

The ministry said the release of this decision reflects its commitment to ensuring a level playing field for all taxpayers, enhancing the principles of tax neutrality and equity in the UAE corporate tax regime, and ensuring such deductions align with international best practice.