Dubai’s off-plan property market has set a new record in the second quarter of 2024, with 25,466 transactions totalling over AED52 billion, a report by Betterhomes said.

This represents an 81 percent increase compared to the same period last year.

Villas saw a 44 percent year-on-year rise in transactions and a 76 percent increase in value. Off-plan apartments dominated the market with an 86 percent year-on-year increase in transactions.

The surge in activity has been attributed to Dubai’s growing appeal, with each quarter surpassing previous transaction records.

The market has shifted towards off-plan transactions as developers aim to meet rising demand through new project launches.

Dubai, the first emirate to offer property ownership to non-Emiratis, now has the highest future residential supply in designated freehold areas. Over 70 percent of new developments are located in these zones.

“The market sentiment is heavily skewed towards off-plan projects, driven by a notable shortage of ready-to-move-in inventory,” the report added.

Developers have launched over 200 residential projects in 2024, adding nearly 50,000 units to the off-plan market.

The luxury off-plan market, for properties worth over AED15 million, remains strong. Palm Jumeirah leads with 51 transactions, followed by Dubai Water Canal and Dubai Healthcare City II with 28 and 18 transactions, respectively.

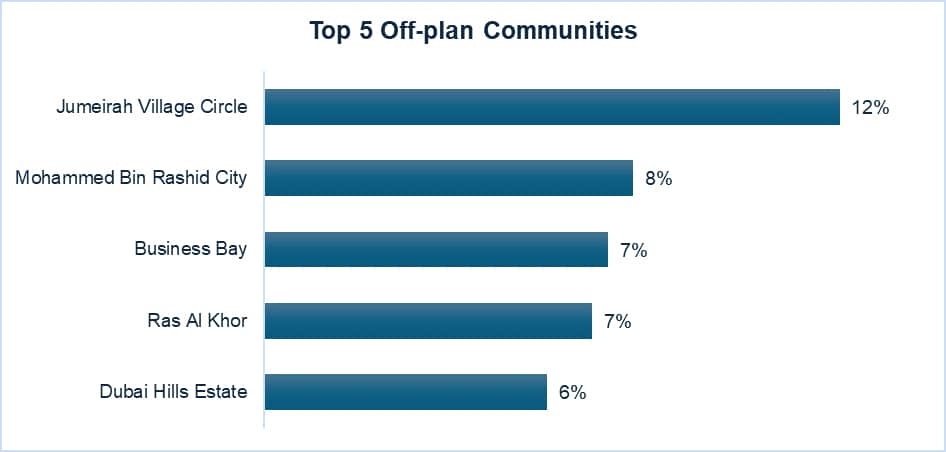

The top five areas for apartment and villa transactions in Q2 2024 were from Jumeirah Village Circle, Mohammed Bin Rashid City, Business Bay, Ras Al Khor and Dubai Hills Estate, the report said citing Property Monitor.

Dubai’s off-plan property market continues to attract a range of buyers. In the villa segment, properties priced between AED2 to 5 million account for 75 percent of sales.

This price bracket draws buyers who seek more space and features without entering the high-end market.

The off-plan apartment market sees properties under AED2 million dominating, making up 71 percent of total transactions. This price range appeals to middle-income earners, expatriates, and investors with lower capital, due to its affordability and accessibility.